Omnium integration for St. Galler Kantonalbank

Paradigm shift in consulting with Omnium

The result

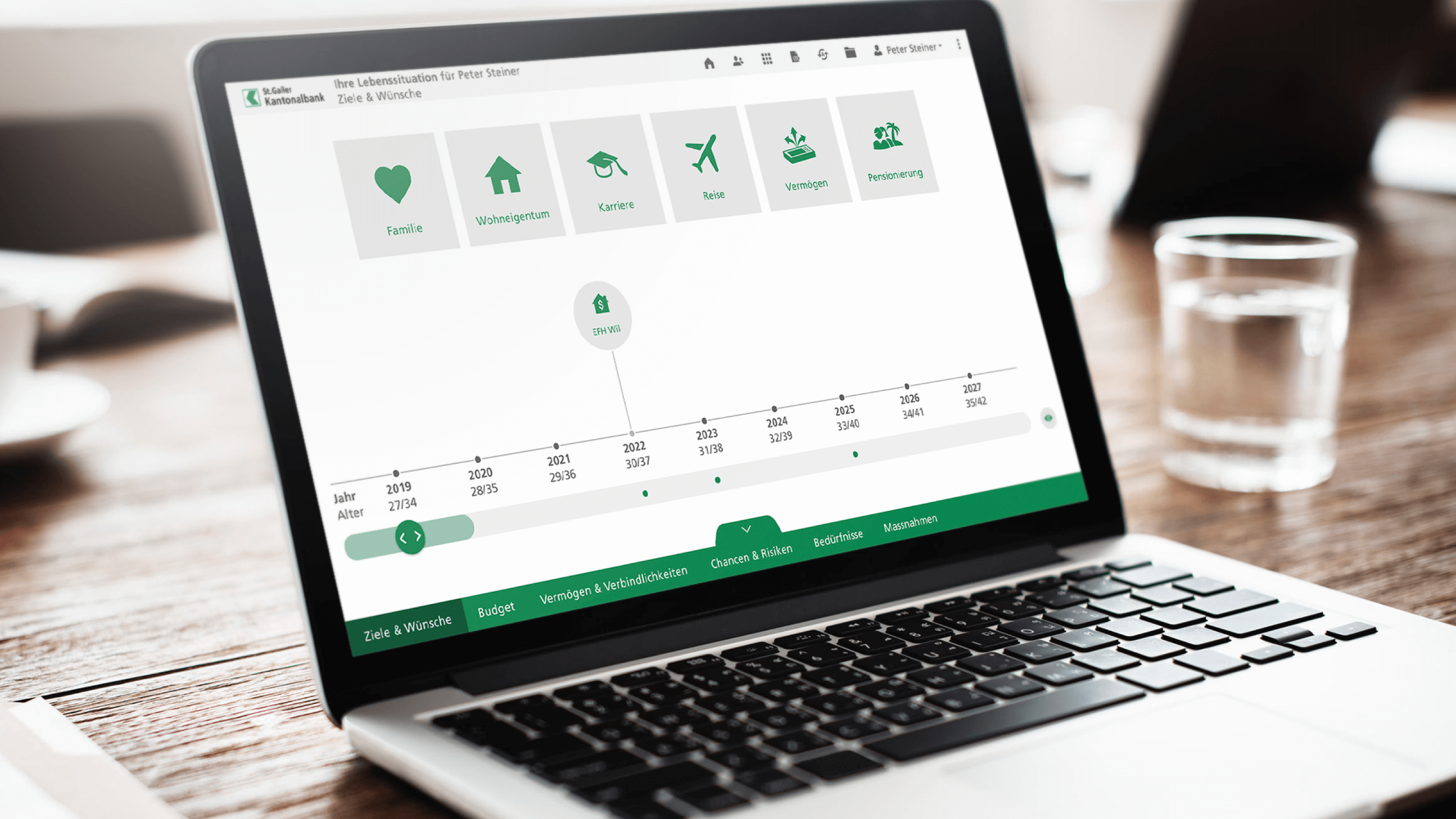

Today, Omnium is the central tool for providing customer advice at St.Galler Kantonalbank. Face-to-face consulting with Omnium is standardised among advisors across topics – i.e. for analysing life situations, the mortgage business and retirement planning. Third-party solutions for the investment business are also integrated.

The new consulting process with Omnium is highly rated by advisors as well as customers. This is the result of a comprehensively supported approach.

The initial situation

In 2017, St.Galler Kantonalbank adopted a new strategy of goal-based holistic advice. The paradigm shift also involved supporting customers through their life cycle. Based on this strategy, a solution was sought in the market for implementation.

Despite gaps in the functionality of Omnium, the already existing modules, the underlying concepts and the proposed approach convinced bank representatives. As a result, Braingroup was awarded the contract with Omnium.

The management of St.Galler Kantonalbank did not simply commission the introduction of a tool for consulting. It started a long-term change process to establish the holistic goal-based consulting philosophy. Tool-based consulting with Omnium as the central application is thus much more than just an IT solution.

The procedure

The entire project was implemented in stages – with a clear vision from the very beginning. The most important project stages were:

- Introduction of the Omnium module Basic Consulting with the following objectives:

- Focus on the customer taking their goals and wishes into account

- Providing an overview of the financial situation of the clientele (entire household)

- Taking measures to achieve the financial goals of the clientele

- Preparing follow-up discussions (financing, investing, providing for the future)

- Introduction of the investment advisory module, i.e. integration of the existing portfolio management application “FINFOX Touch” with following objectives:

- Realisation of goal-based investment advice

- Improved consulting experience due to interactive simulations

- Access to relevant information/documents such as recommendation lists, fact sheets, etc.

- Introduction of the Omnium module Pension provision with following objectives:

- Raising customer awareness of risk events such as disability, death and retirement

- Market positioning as a holistic bank

- Gateway to special advisors

- Introduction of the Omnium module Financing with the following objectives:

- Assessment of a property value through the integration of hedonic estimation models

- Showing the clientele their viability for real estate financing

- Offer customers various financing options and mortgage products within one system

- Increasing the customer experience in consulting through the integration of additional external services

The advantages

- The bank has established a customer-centric, digital advisory approach with Omnium.

- Consultants and customers rate the consulting experience with Omnium highly

- Thanks to well thought-out and consistent processes, the bank has created flexible foundations for further consulting topics.

- The comprehensive change program was widely supported by the bank at all levels