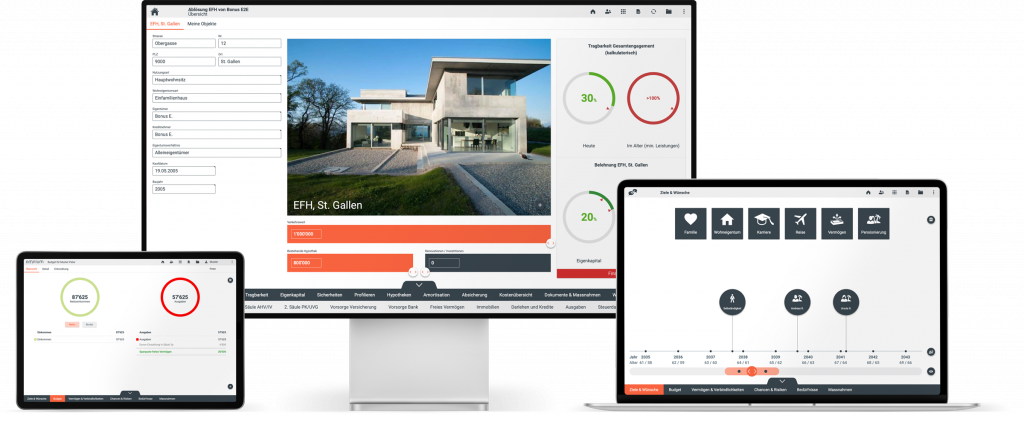

An Omnium consultation becomes an interactive experience from preparing a meeting to closing it online.

Why Omnium?

Customer loyalty

The advisory experience, the holistic view of the customer’s financial situation and goals create the basis for customer loyalty and retention.

Cross- & Upselling

The variety of modules and their intelligent combination guarantees optimal cross- & upselling potential.

Efficient processes

Clear and flexible user guidance and the large number of integration points enable efficient end-to-end processes.

Consulting quality

Simple visualisations and interactive graphics support the advisor and strengthen the customer’s understanding and transparency at the same time.

Consulting experience

Omnium supports the consultation digitally and holistically due to visualisations and simulations. A consultation is interactive, clear and guarantees a unique consulting experience.

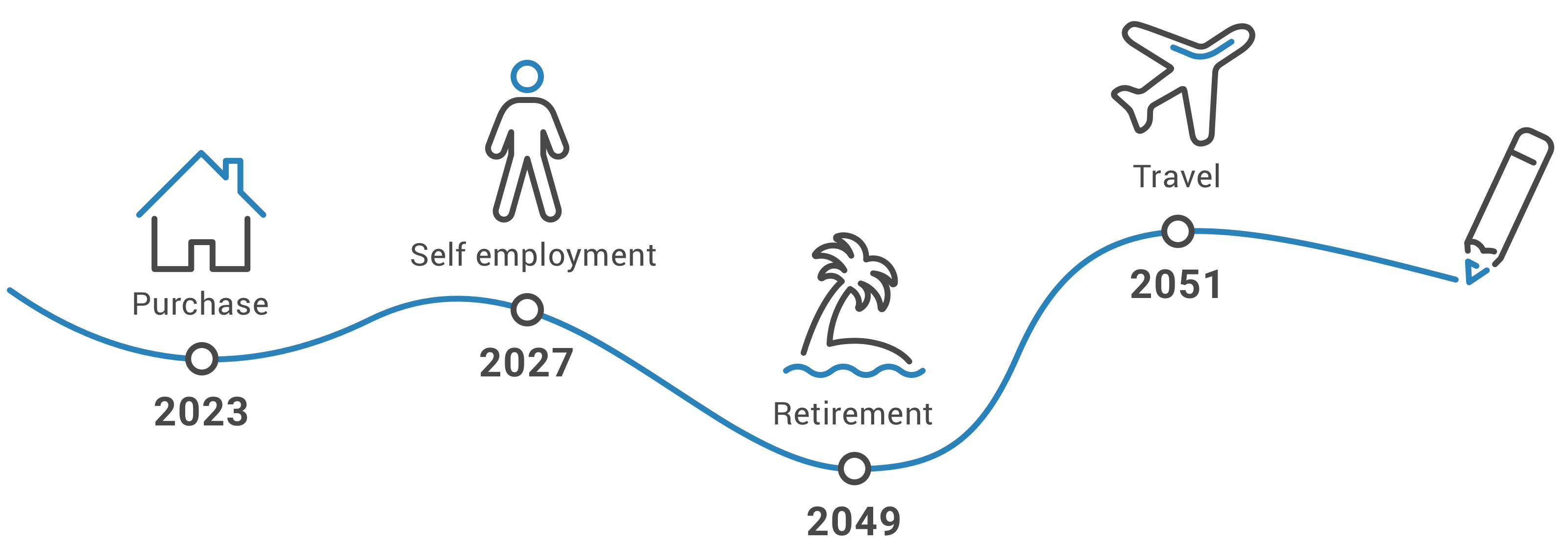

Goal-based consulting

Customer’s goals, wishes and needs are the basis for holistic consulting. Omniums flexible modules support goal-based consulting which is tailored to the current life situation as well as the entire life cycle of your customers.

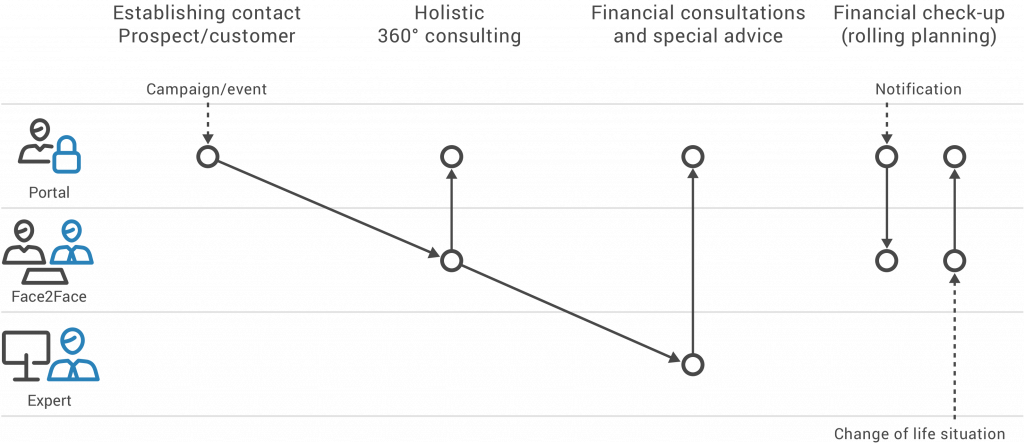

Omnichannel

Omnium enables sustainable customer interaction across all channels tailored to the needs of your customers whether in a face to face or remote consultation with an advisor or online on the customer portal.

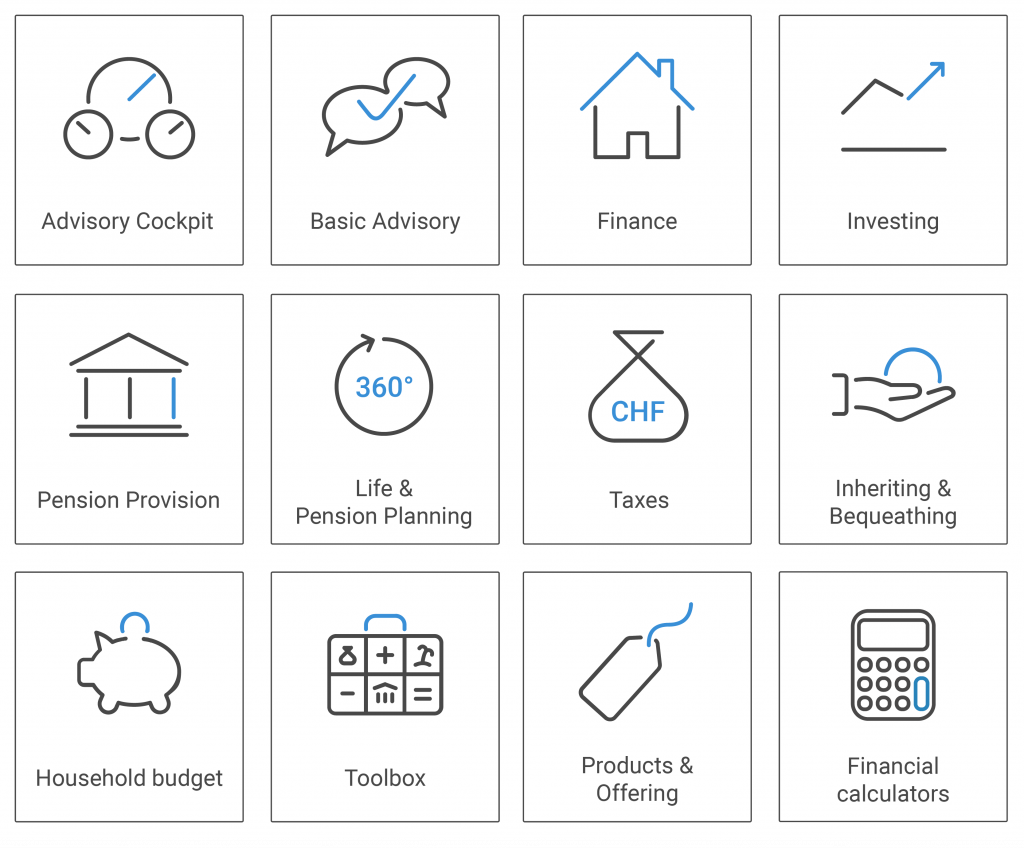

Modules & Topics

Omnium offers a choice of more than 10 advisory modules. It provides everything from a single source – whether it is goal-based basic advisory, advice for financing a home or comprehensive pension planning. Data needs to be entered only once in the central customer profile and is immediately made available for all relevant modules.

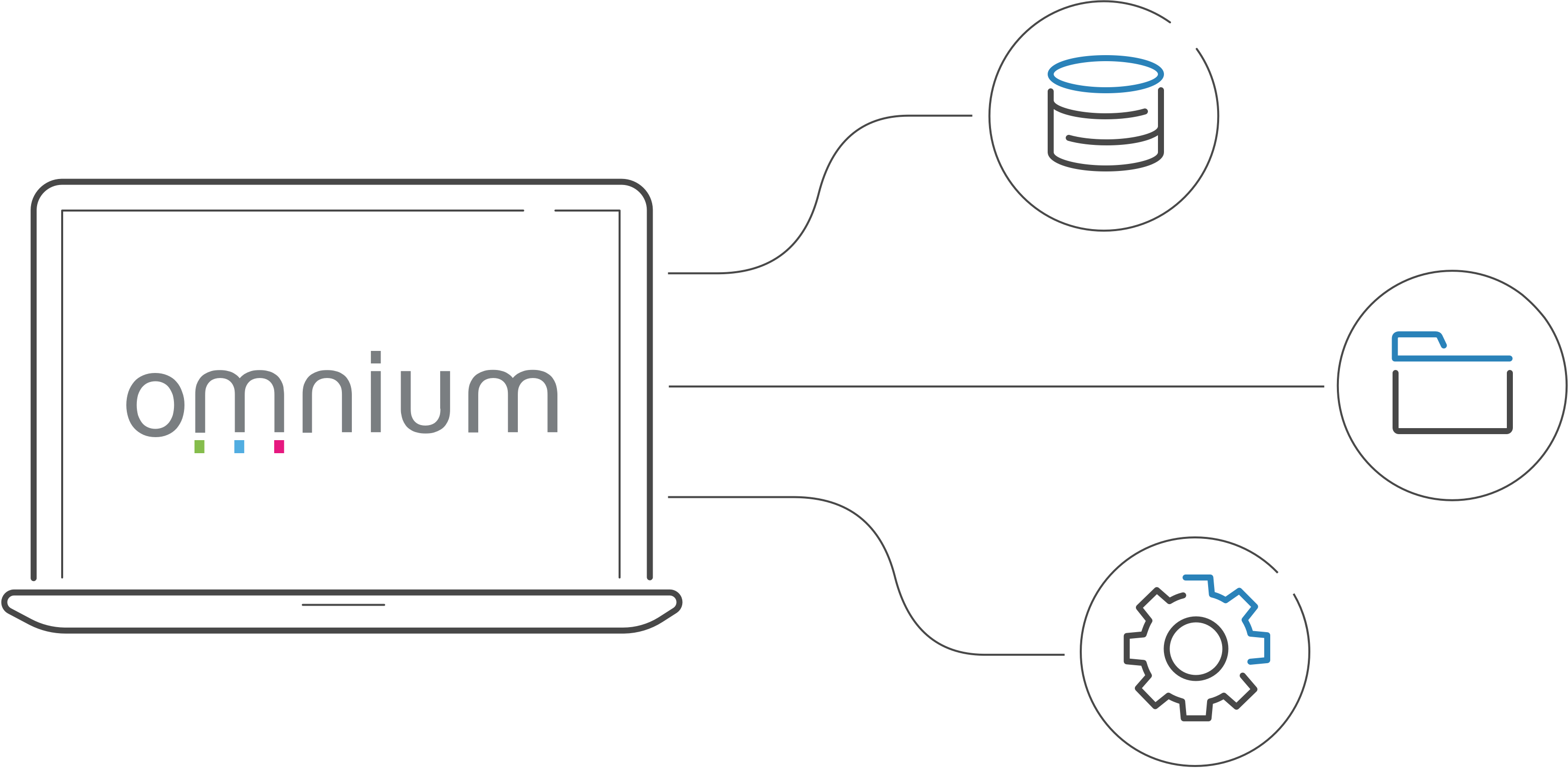

Integration

Integration options are provided through a comprehensive selection of standardised interfaces. Use cases are for example importing or exporting updated asset values, calculating viability, obtaining quotes or archiving documents. Our clients – banks or insurance companies – define the desired level of integration.