ATG Allfinanz & Trust AG

De la solution Excel à Omnium Planification de la vie et de la retraite

«Avant, je n’aurais jamais pensé que l’utilisation d’un outil dans le conseil pouvait être aussi efficace.»

Gabor Gaspar, associé chez ATG Allfinanz & Treuhand Group AG

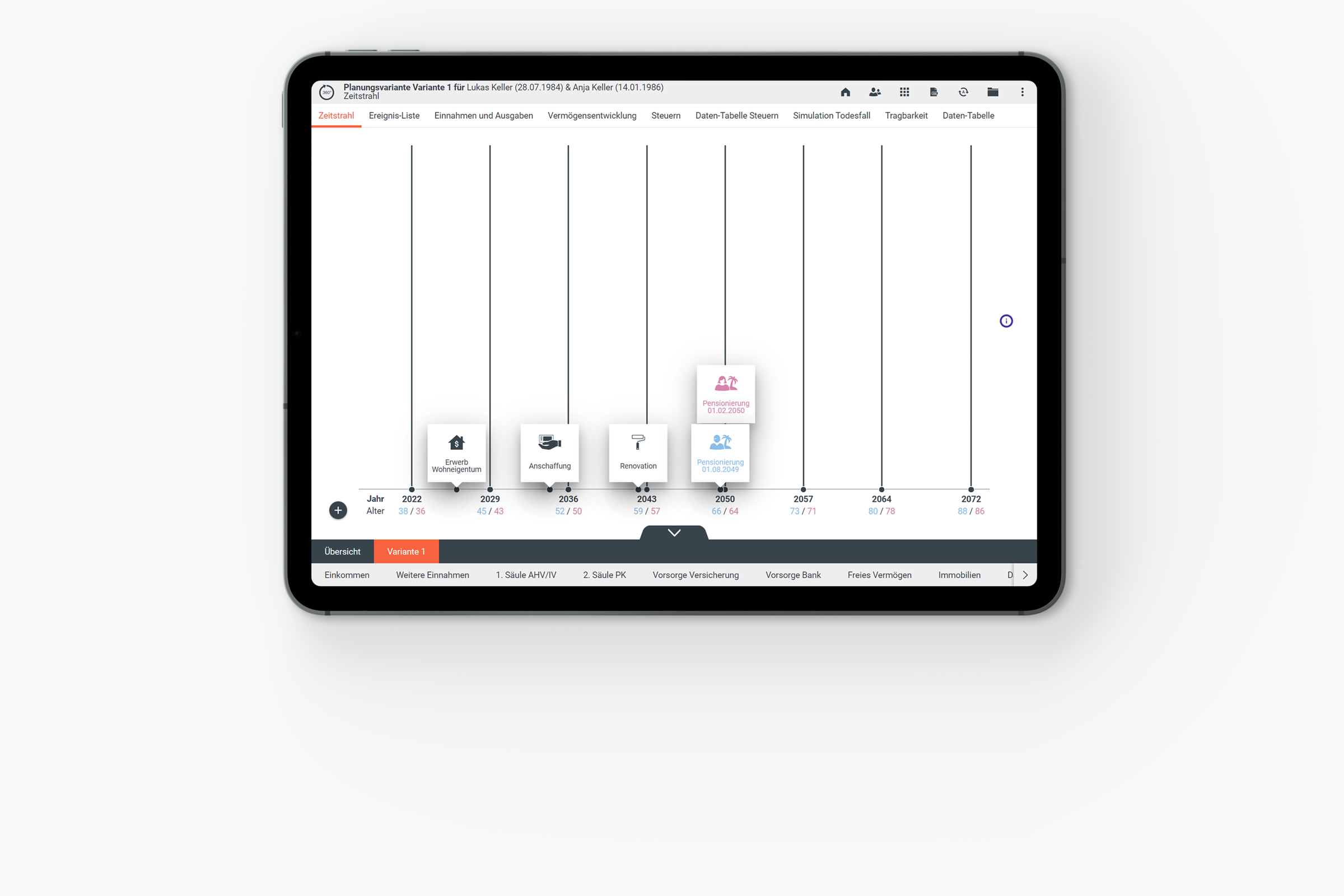

Aujourd’hui, je montre aux clients les planifications avec Omnium en direct à l’écran. Les changements d’événements de la vie et les optimisations sont directement visibles à l’écran – l’effet “waouh” immédiat est garanti.

Le résultat

Les conseillers financiers d’ATG utilisent aujourd’hui toutes les possibilités offertes par Omnium Planification de la vie et de la retraite. Pendant le conseil, l’Omnium est utilisé “en direct”. Les données de base sont saisies, complétées et traitées ponctuellement, et les vues de planification sont examinées et élaborées ensemble. Toute la paperasserie est supprimée. Une version papier n’est établie que sur demande explicite. Sinon, le client reçoit la solution élaborée par e-mail avec une pièce jointe au format PDF.

La situation de départ

Depuis de nombreuses années, ATG établissait ses planifications financières sur une solution Excel développée en interne. Les possibilités de représentation des processus de planification financière étaient certes très variées, mais la solution était également sujette à des erreurs et un contrôle avec le principe des quatre yeux était quasiment impossible, voire très chronophage. En outre, en plus de l’effort initial important, il fallait également tenir compte des frais de maintenance constants et les données fiscales n’étaient intégrées que de manière très rudimentaire dans la planification. Un autre inconvénient était qu’il n’était pas possible de montrer au client des vues d’écran pendant l’entretien. On ne travaillait que sur papier et les révisions rapides et leurs conséquences ne pouvaient pas être présentées de manière claire.

La procédure

ATG a évalué différents fournisseurs de logiciels sur le marché suisse. Le rapport qualité/prix d’Omnium a très vite convaincu la direction. Une fois la commande passée, l’installation des comptes des conseillers et les configurations spécifiques à l’entreprise ont pu être effectuées. La mise en service dans le modèle Omnium Software as a Service n’a duré que quelques jours. Un “power user” s’est établi dans l’entreprise, qui s’est intéressé de près à Omnium planification de la vie et de la retraite ainsi qu’à l’analyse de la prévoyance. Ses connaissances ont été transmises en permanence aux autres collaborateurs. Braingroup a apporté son soutien sous la forme d’une brève formation et d’une assistance par téléphone, par e-mail ou en “équipe” avec transmission sur écran.

Les avantages

- Les conseils financiers et les planifications financières d’Omnium peuvent être utilisés “en direct” via une tablette, toute la paperasserie actuelle est en grande partie supprimée.

- Les représentations graphiques et les animations de l’outil de conseil sont appréciées par les clients, l’expérience de conseil est garantie à tout moment.

- Le contrôle à quatre yeux est possible de manière efficace avec Omnium

- Les chiffres clés de la prévoyance et les données fiscales sont automatiquement mis à jour plusieurs fois par an, aucune installation de mise à jour n’est nécessaire.