Integration project for Baloise Insurance

Strategic consulting platform

The result

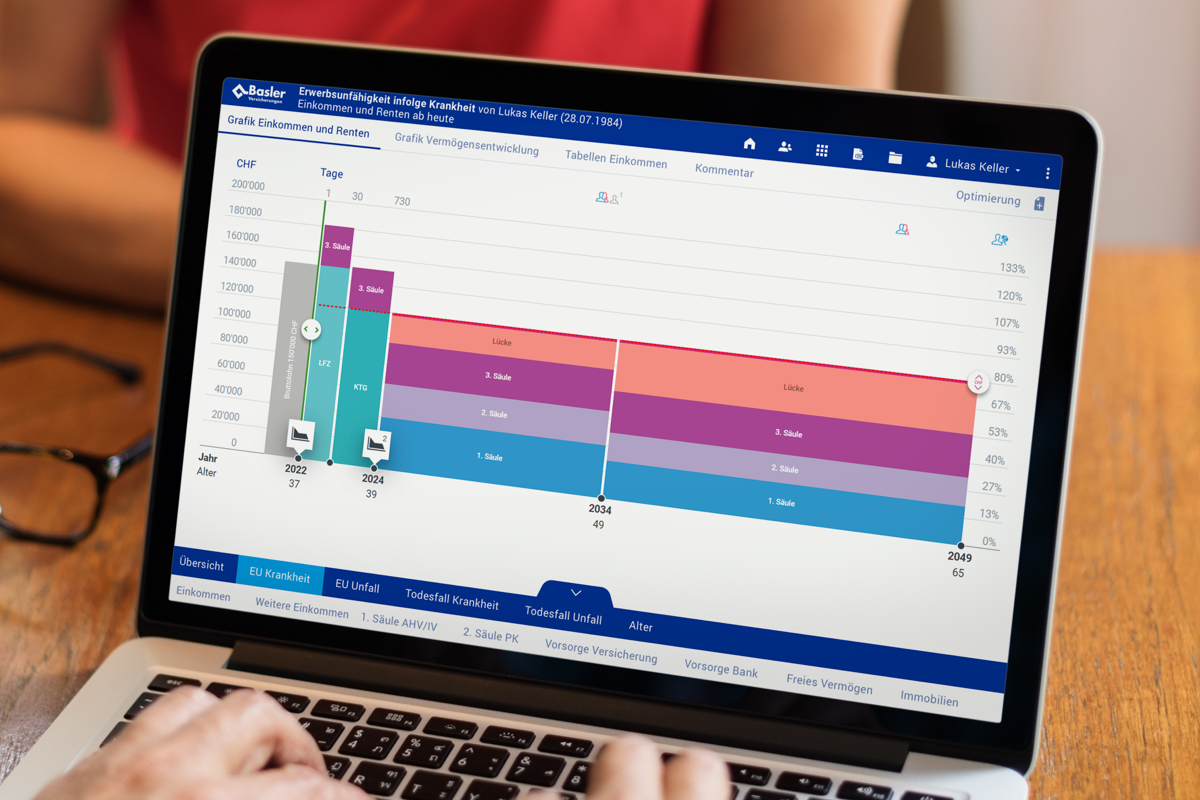

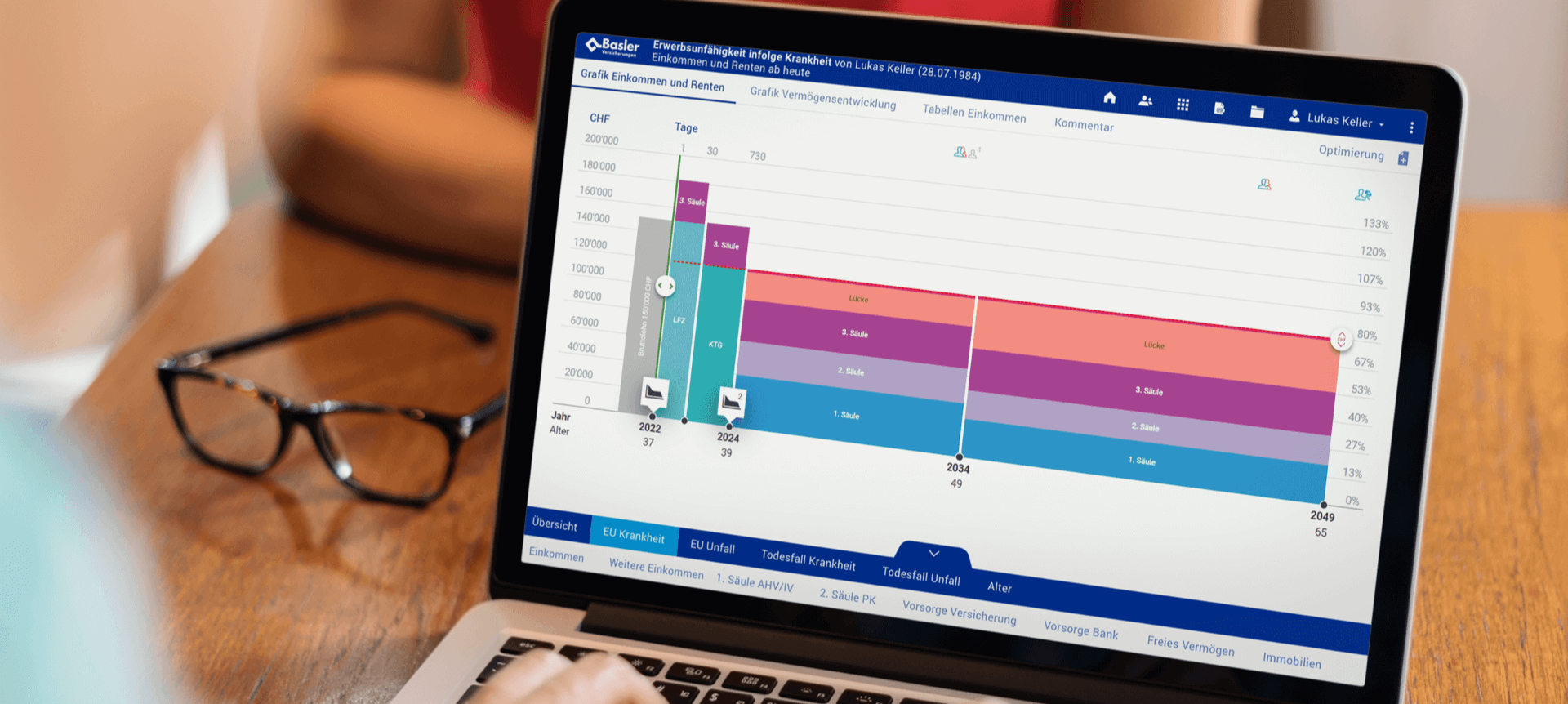

With Omnium, Baloise Insurance has a comprehensive digital consulting platform that is used extensively by both thesales team and experts.

The main focus is on pension provision and pension planning. As result of using also other modules such as tax and investments, Baloise Insurance can offer holistic consulting services as well as benefit from economies of scale of a comprehensive IT solution.

The Omnium financing module was introduced nationwide at Baloise in 2023. The expansion of the existing Omnium Suite underpins the vision of a strategic consulting platform.

The initial situation

The individual solution of Baloise Insurance for pension analysis and investment consulting was technologically outdated. Calculation services for pension analysis were already provided by Braingroup at that time.

Basic elements of the old solution such as an attractive and intuitive front end had been already tried and tested. Keeping it simple while offering comprehensive functionality was focused on when developing the new solution.

The vision was consulting on a holistic level, including an omnichannel strategy. The solution also had to support basic consultations as well as special expert use cases.

The procedure

Baloise Insurance was aware that high acceptance of the software solution among advisors is a key factor for success. Therefore, many frontline employees were involved in the evaluation process in which Omnium received the highest marks of all providers.

The introduction of a comprehensive consulting solution requires adjustments in various areas. Important elements in the project were:

- Baloise Insurance were one of the first Omnium customers. The pension module was functionally extended to meet experts’ needs.

- It turned out that the configuration options and flexibility of Omnium are so great that there was no need for additional customisation of the product. Customisation was limited to visual elements in the frontend and customer print document.

- Even before the project started, it was clear that integration of Omnium into the surrounding systems is a central factor. Integration is key in order to improve efficiency and to achieve a high level of user acceptance. At the same time, such integrations are expensive and increase project complexity. Therefore, only a partial integration was done- at a level that provided the optimal cost-benefit ratio.

- An important part of the project was the comprehensive training of all employees in the consulting department. This ensured that advisors could use the tool in customer consultations with great confidence and realize it’s benefits.

The advantages

- Baloise Insurance has established a comprehensive digital consulting platform that guarantees high quality and efficiency.

- Omnium can be used for both short consultations and comprehensive expert consultations.

- The intuitive front end makes it easy for new employees to get quickly used to the consulting tool.