Modules & Topics – as diverse as your customers! Depending on the focus and target clientele, Omnium covers the entire range and depth of topics in financial consulting.

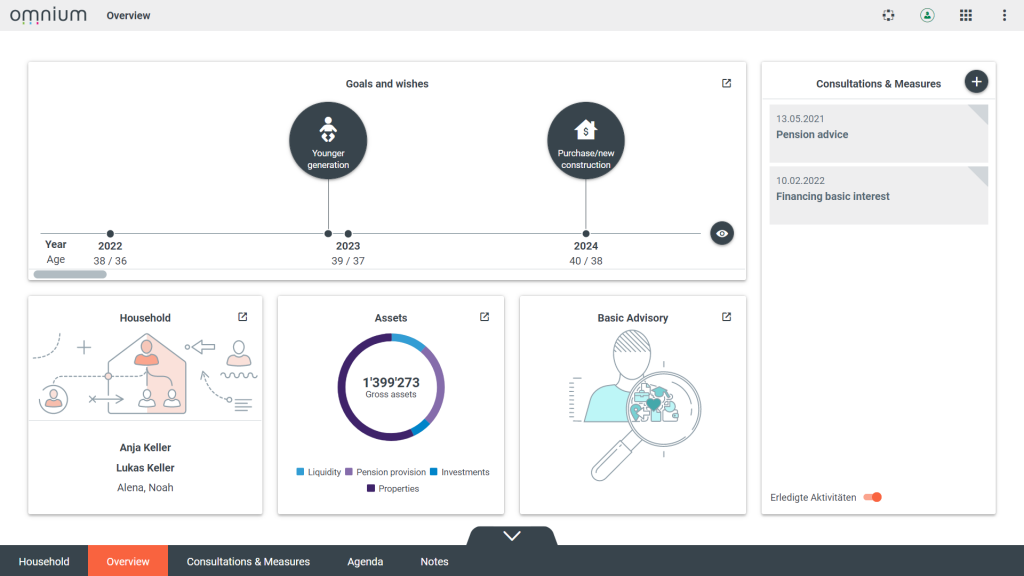

Advisory Cockpit

Module 1 of 11

The cockpit is the entry point into Omnium’s diverse consulting world for both the advisor and the customer. Two separate areas with all necessary functions offer the advisor the ideal separation between preparing the conversation and the actual consultation with the customer.

Topics & functions

- Houshold

- Agenda (including integration of documents and links)

- Consultations (consultation cases and status handling)

- Notes

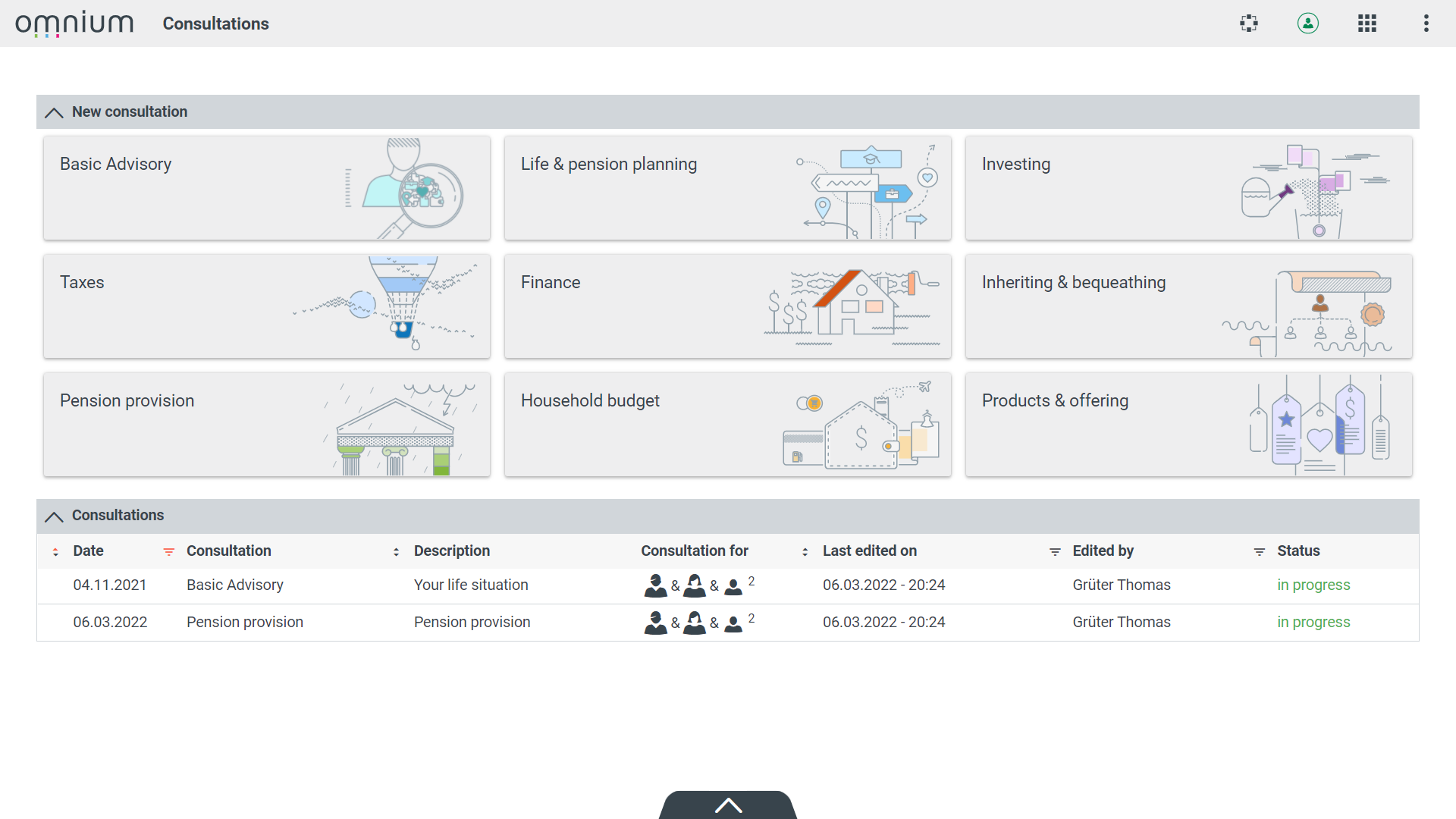

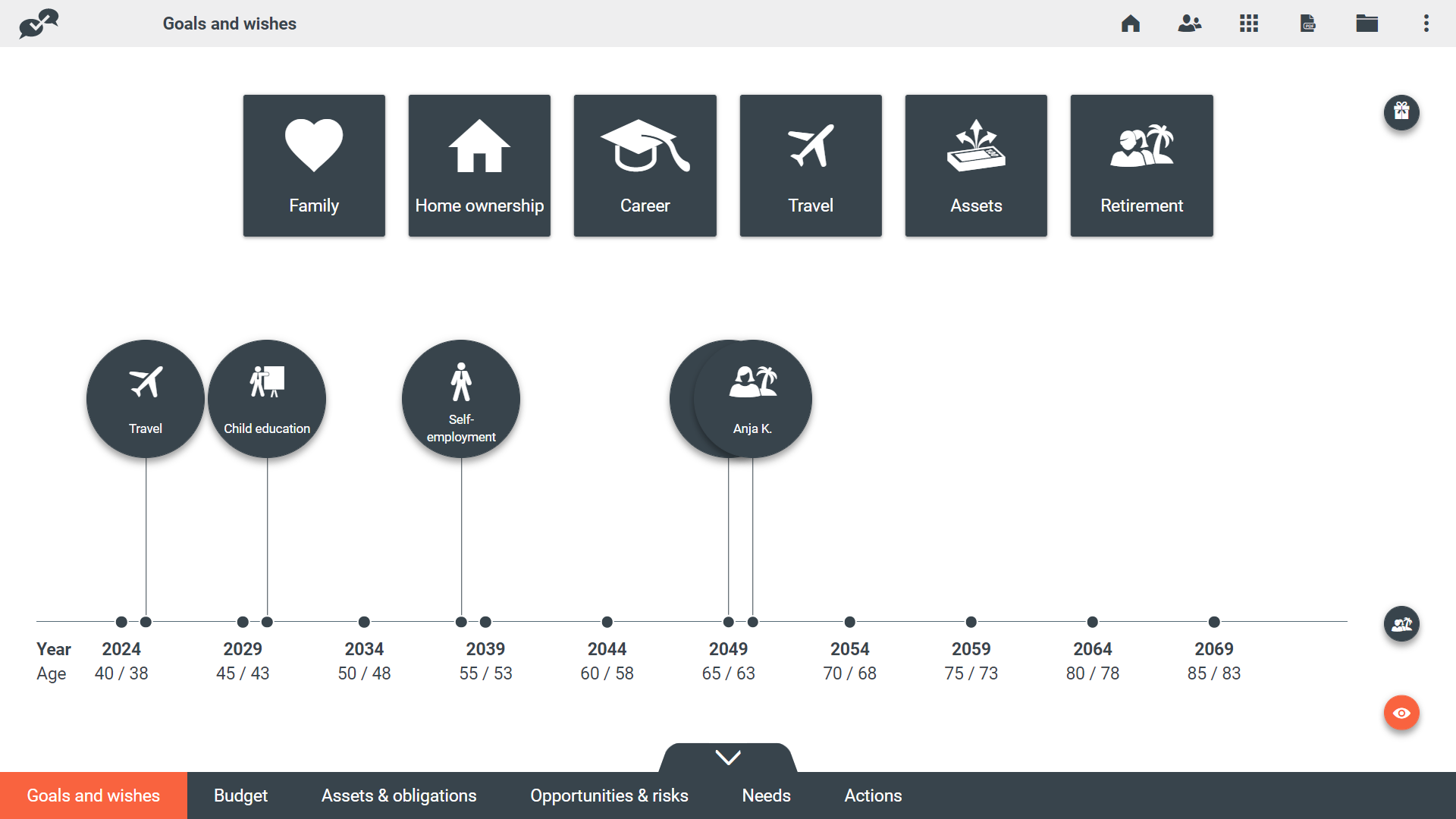

Basic advisory

Module 2 of 11

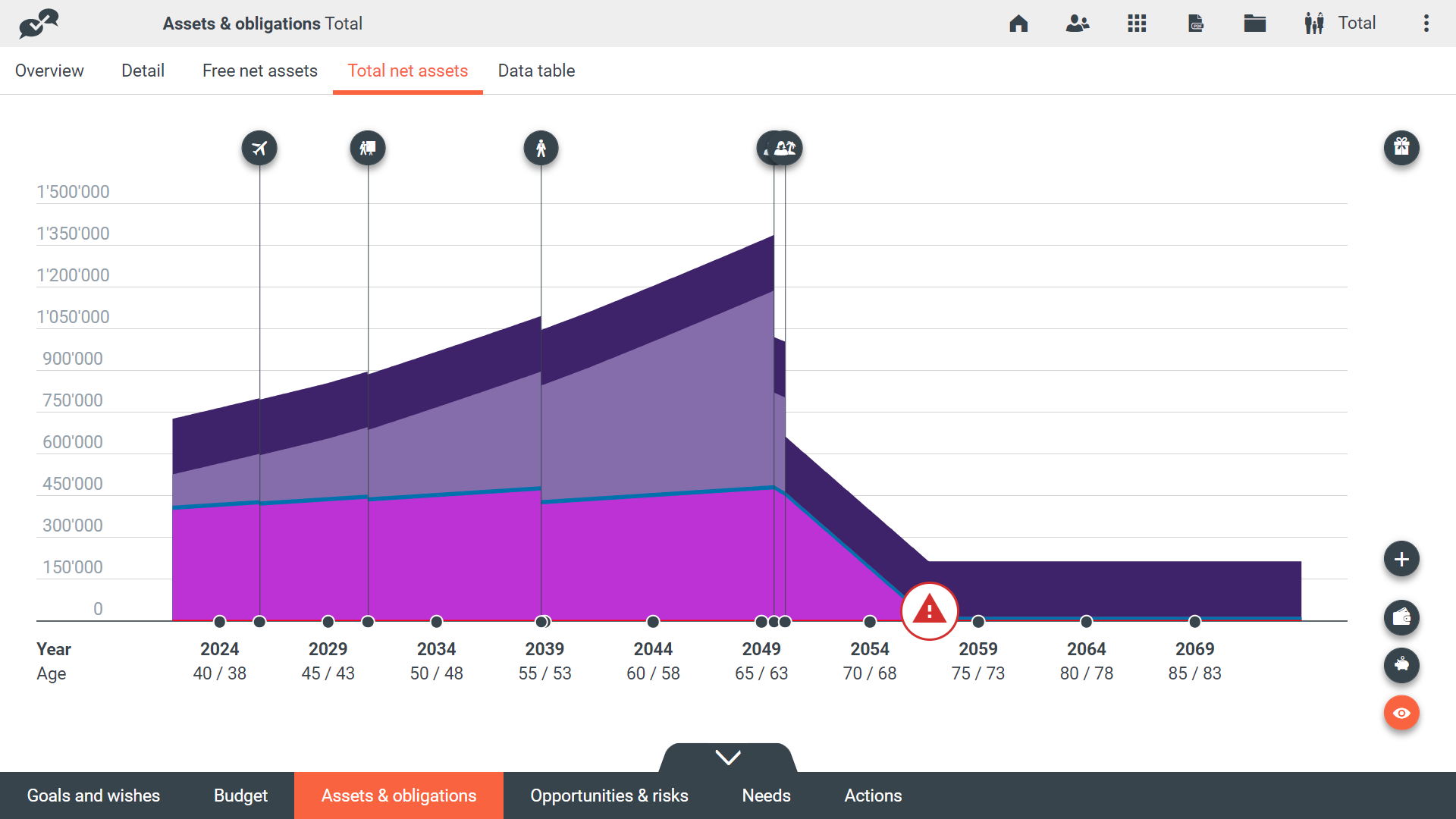

The basic advisory module allows to analyze the customer’s financial situation together with the customer and address possible opportunities and risks.

The smart integration of financial services and products and the definition of concrete actions enable needs- and goal-based consulting.

Topics & functions

- Goals & wishes

- Budget

- Assets & obligations incl. development before and after retirement

- Opportunities and risks

- Services and products

- Actions

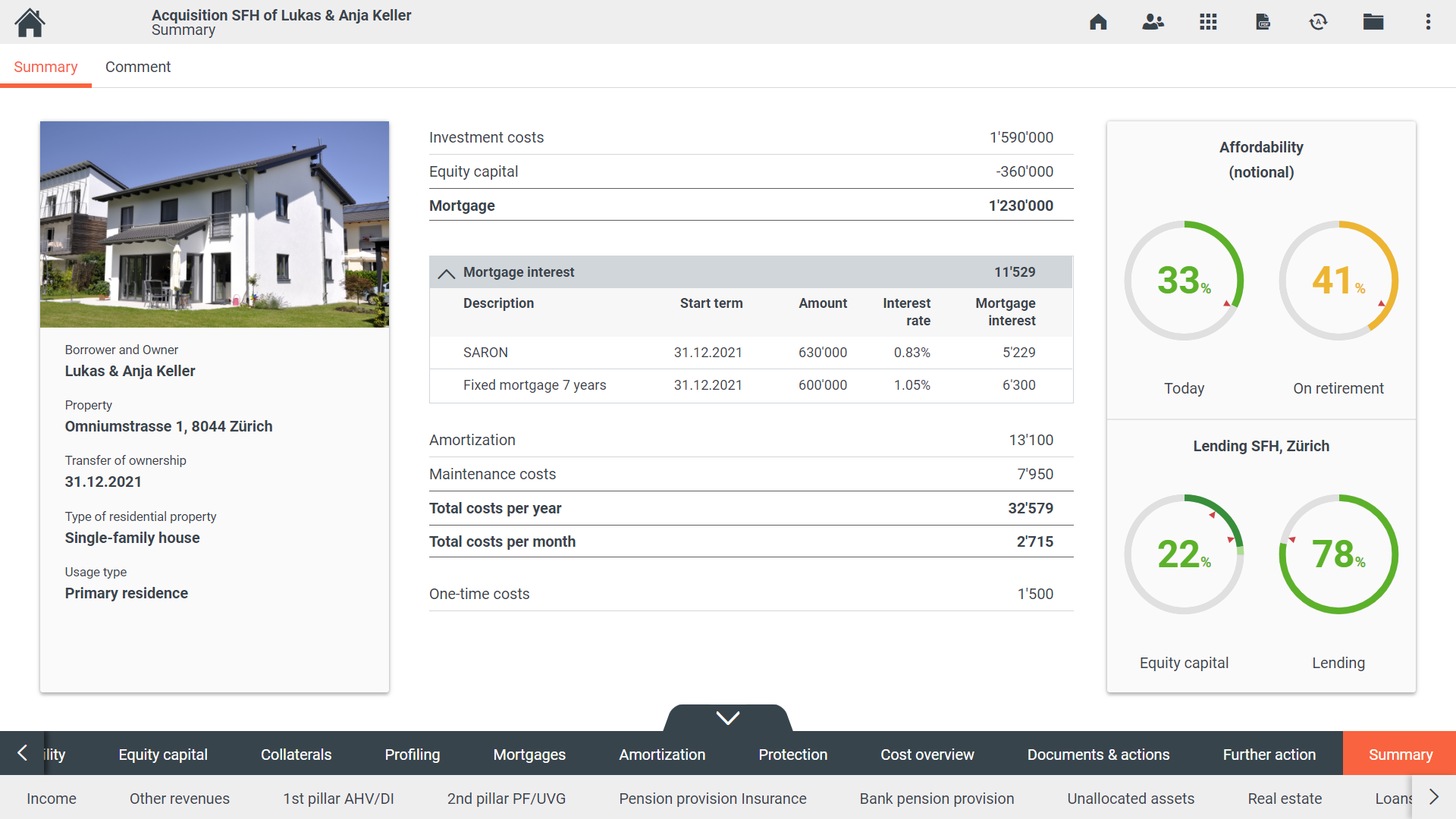

Finance

Module 3 of 11

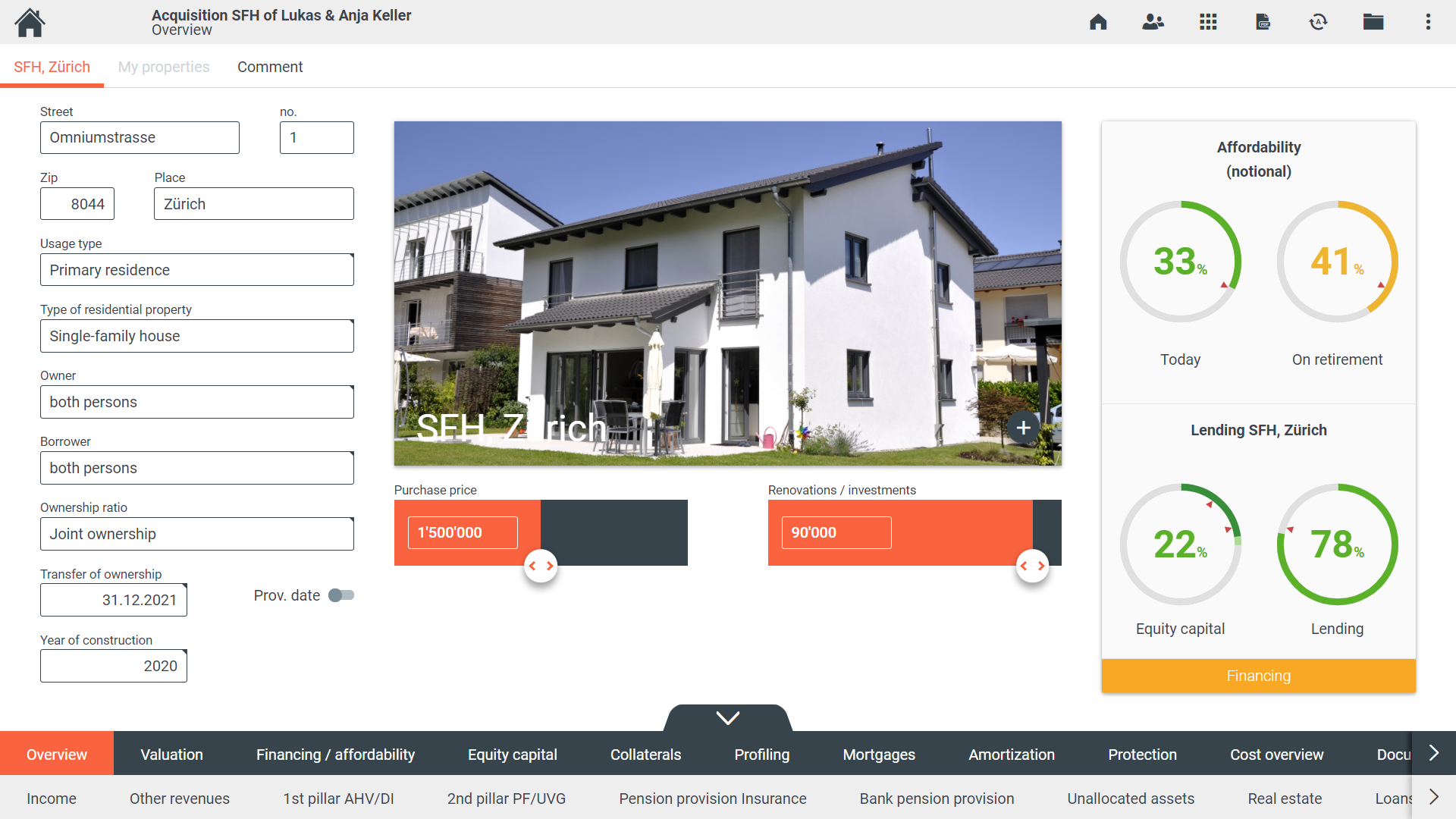

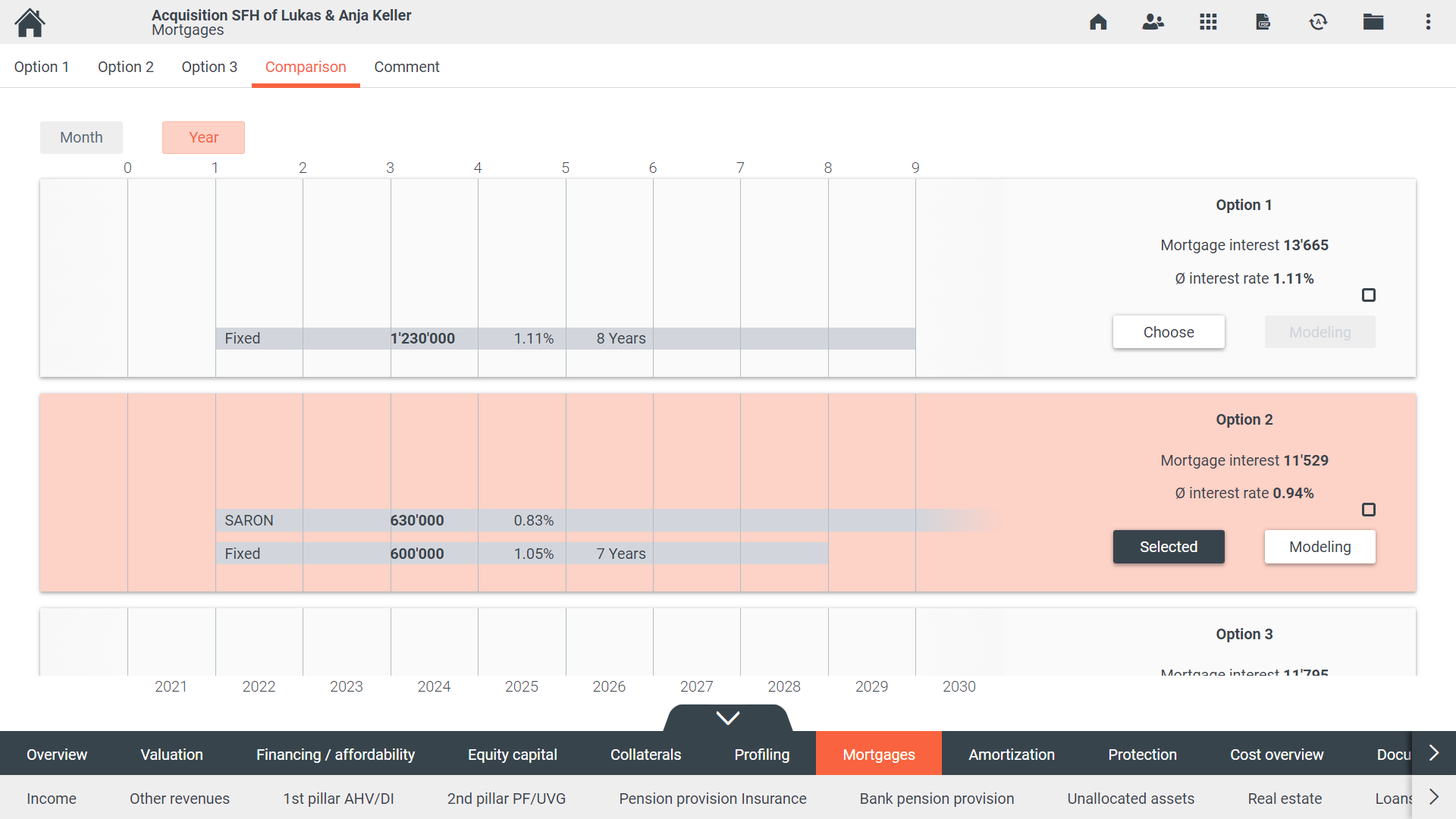

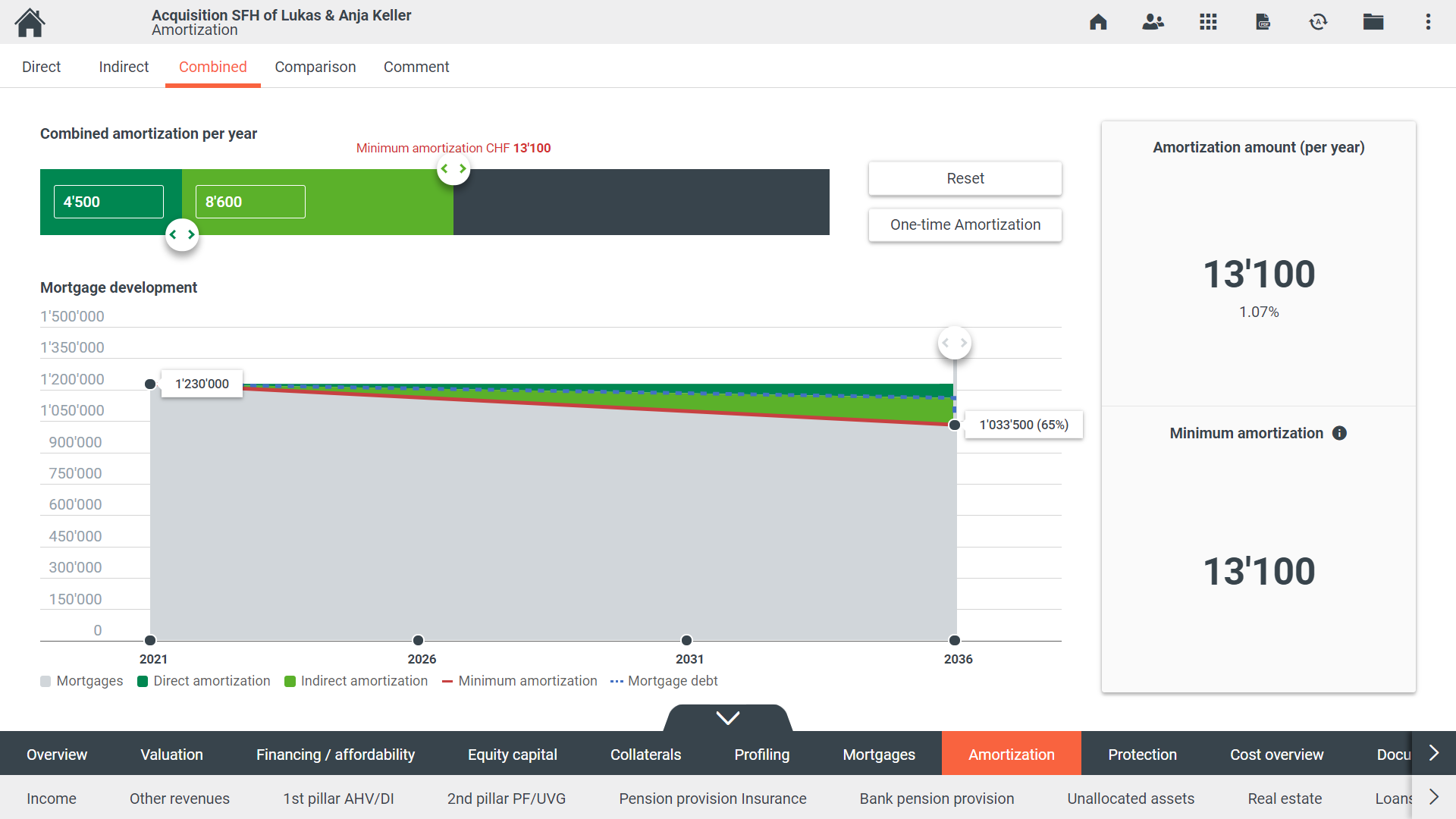

The Finance module covers all business cases in respect of financing private residential real estate (acquisition, new construction, redemption increase, change) up to the binding financing offer. A high level of flexibility can be offered due to comprehensible visualisation, adjustable functional depth and a multitude of integration and configuration options.

Topics & functions

- Valuation

- Financing / affordability

- Equity capital

- Collaterals

- Funding profile

- Profiling Mortgage structuring

- Amortization

- Protection (in the event of risk events and during retirement)

- Cost overview

- Documents & measures

- Further actions

- Summary

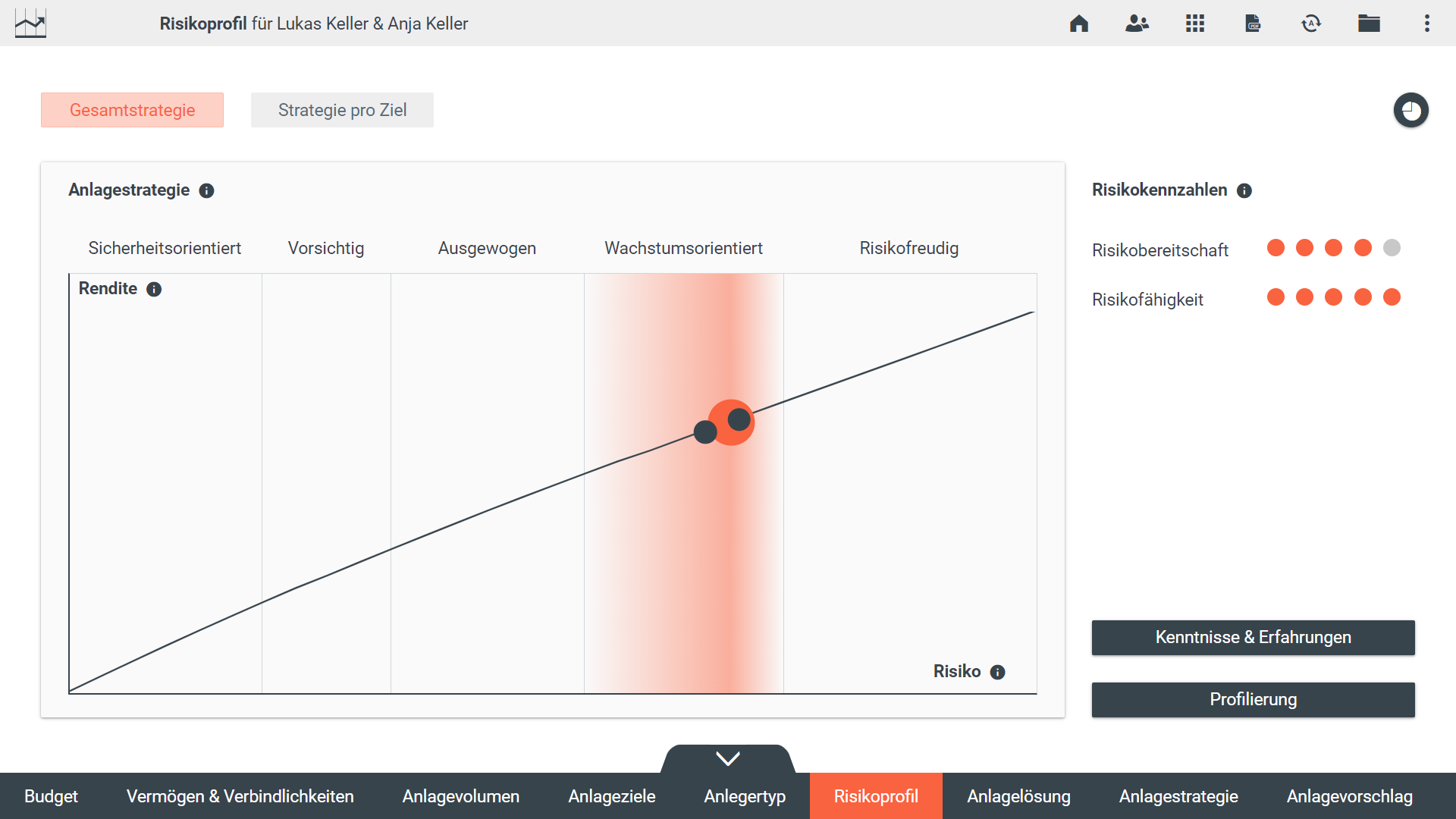

Investing

Module 4 of 11

The Investment module follows the approach of goal-based investing. After establishing the financial situation and the investment volume investment goals are defined. Implementation is based on a suitable asset strategy and investment solution.

Version 1

- Behavioral finance model of BhFS

- Initial investment

- Investor type profiling

- Risik profile

- Asset strategy per goal / overall strategy

- Optimized investment volume and strategy

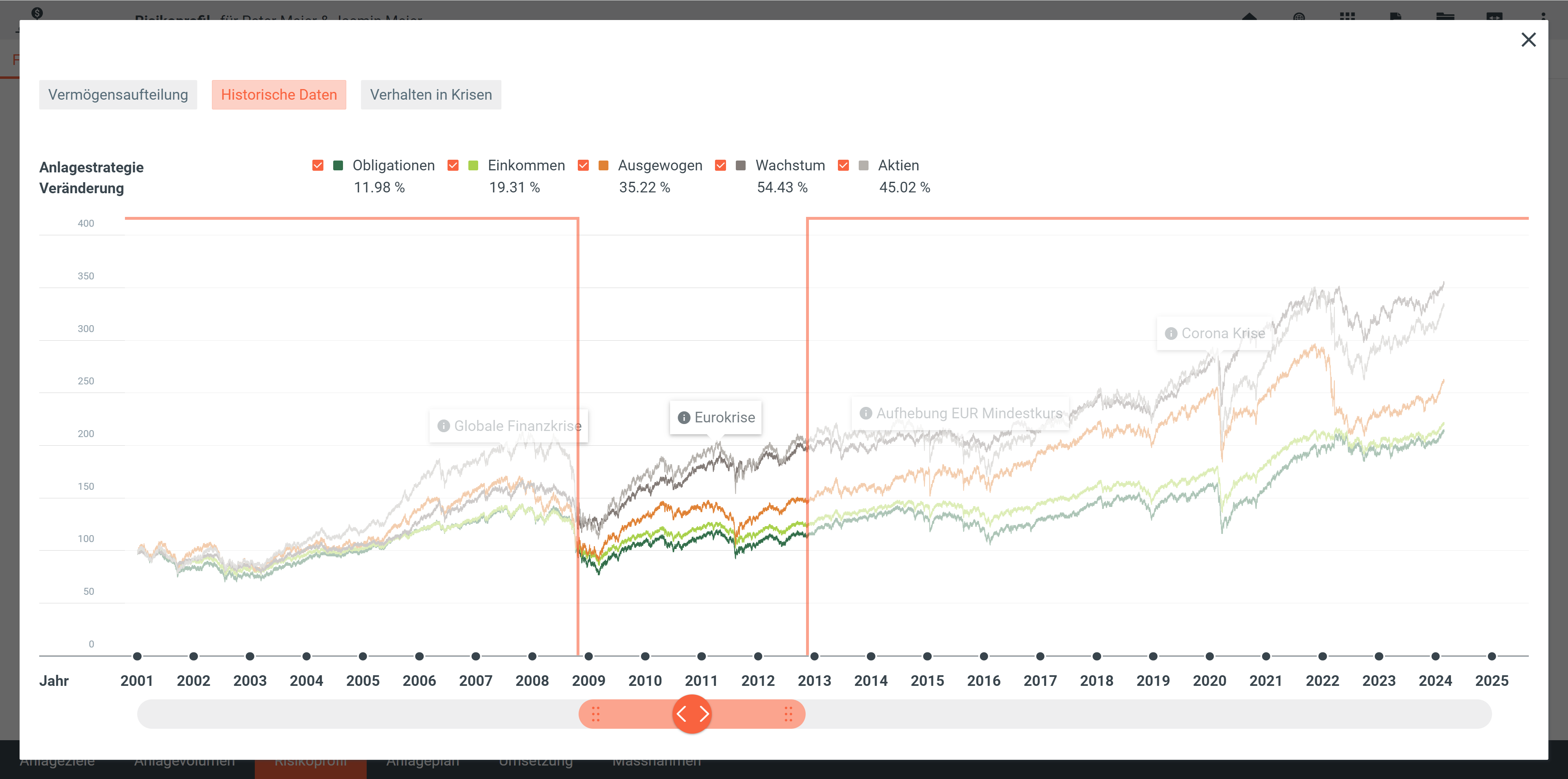

Version 2

- Calculations and projections – implementation by Braingroup or Wealth API (swissQuant)

- Initial investment and review thereof

- Risk clarification by means of projections and graphics as well as classic risk profiling

- Recognition of future cash receipts

- Optimisation proposals

- Monitoring of implemented investment plans

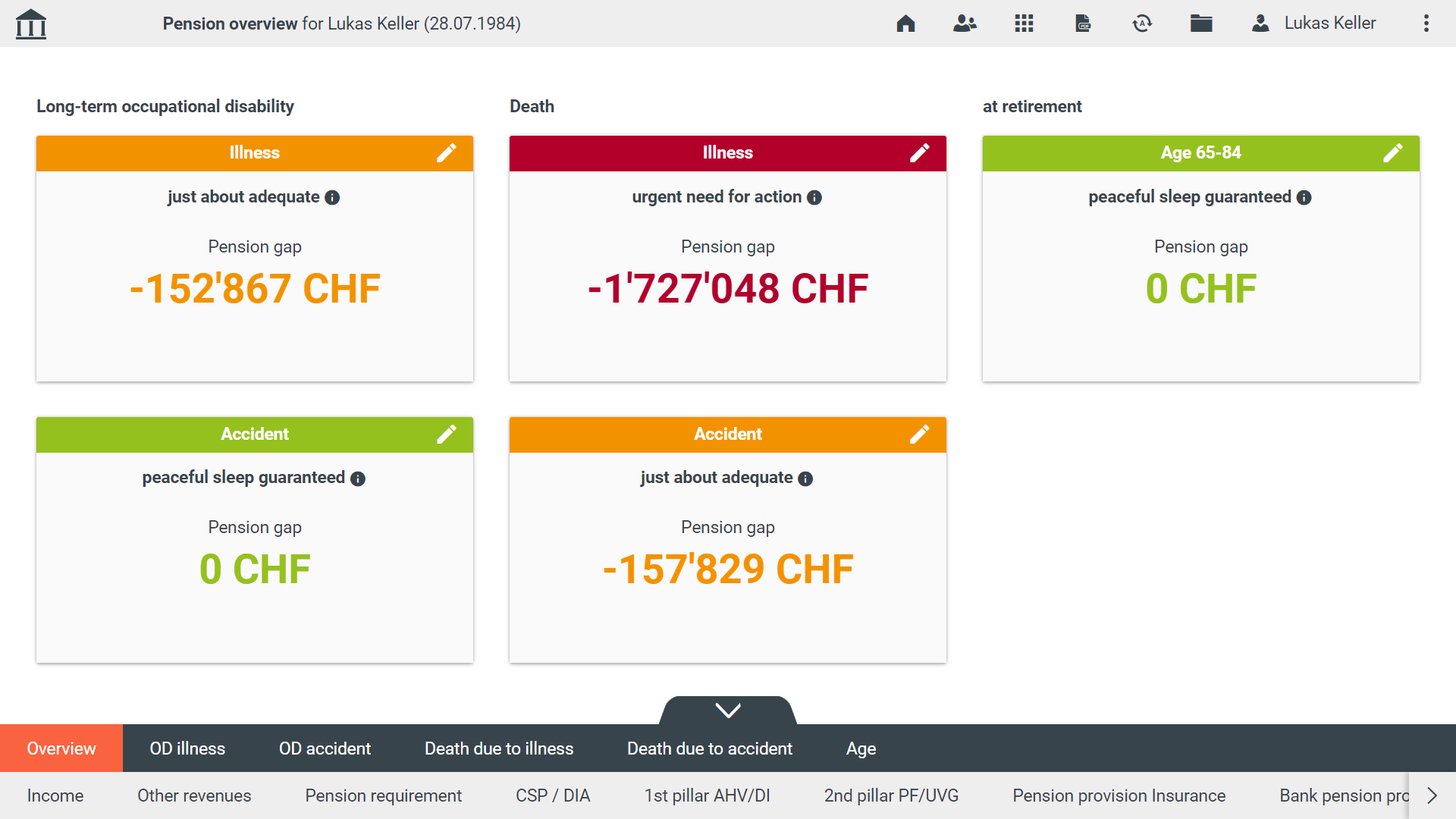

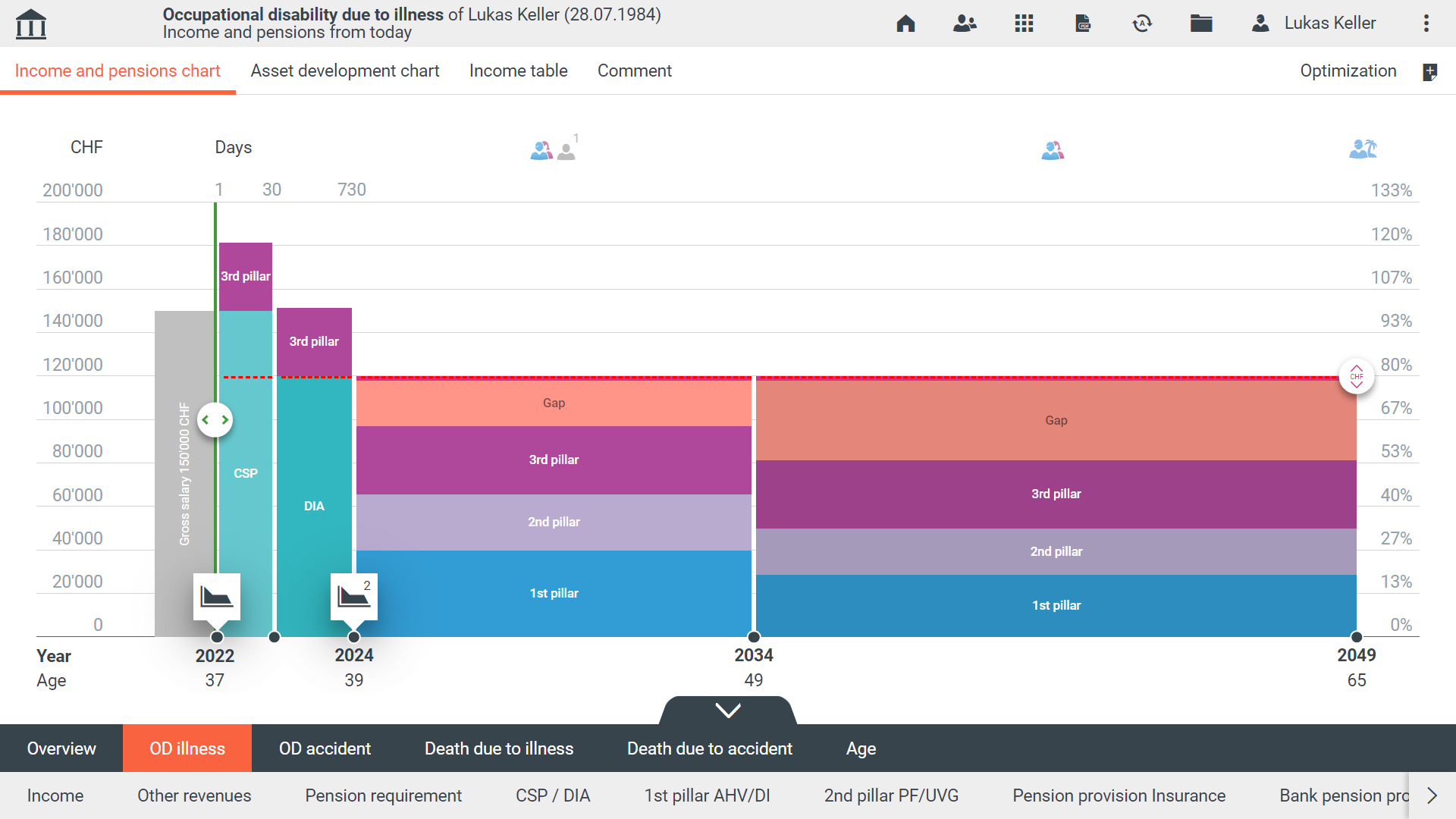

Pension provision

Module 5 of 11

The Pension provision module can be used to create simple provision checks as well as comprehensive risk analyses. The level of depth and breadth of functions made available in the module can be tailored to the needs of individual roles of users via the choice of two configurable modes (BASIC and PRO).

Topics & functions

- Income situation in the short and long term in the event of occupational disability due to illness and accident

- Income situation for surviving dependents in the event of death due to illness and accident

- Income from retirement

- Optimisation of the current situation

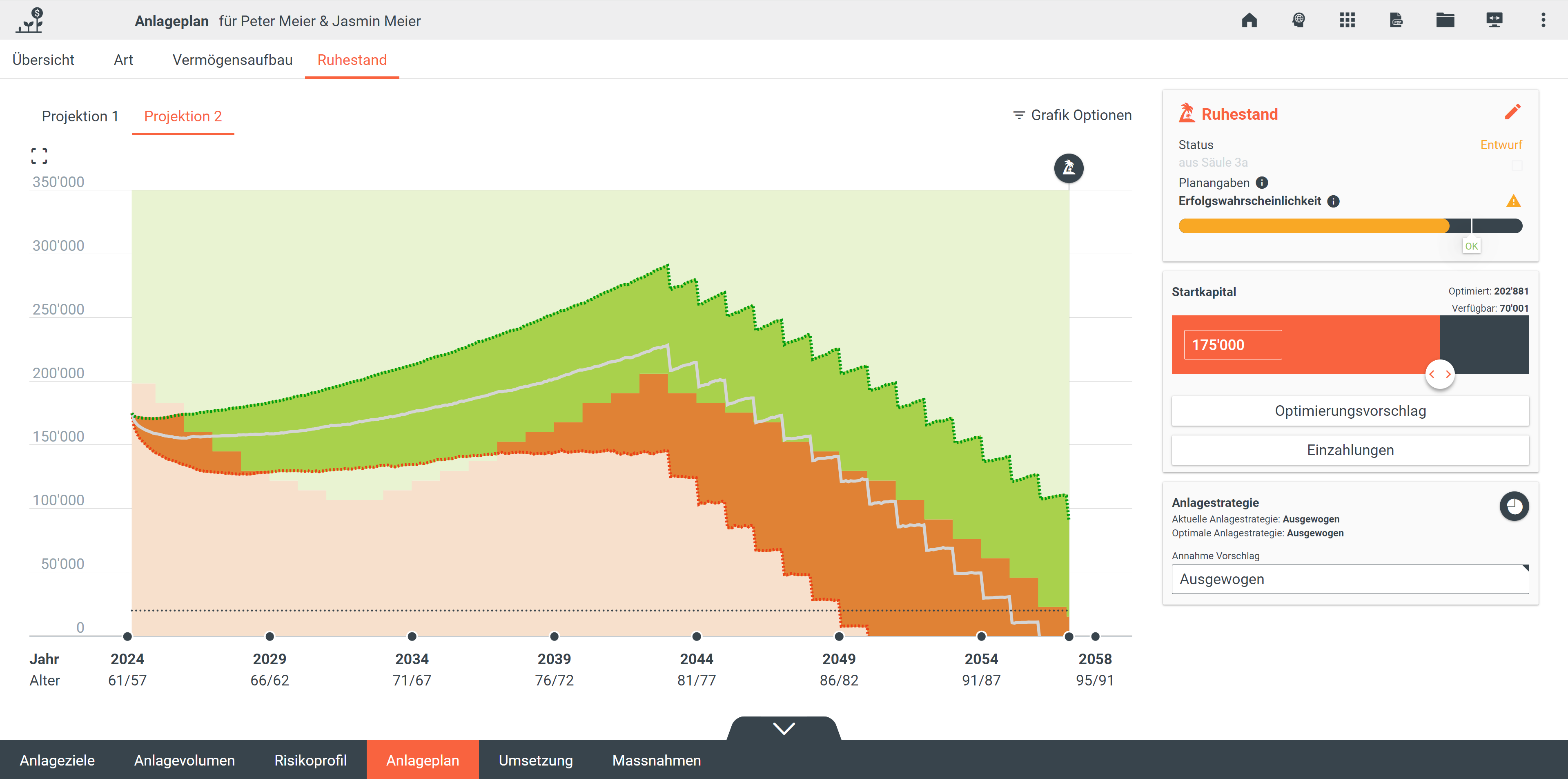

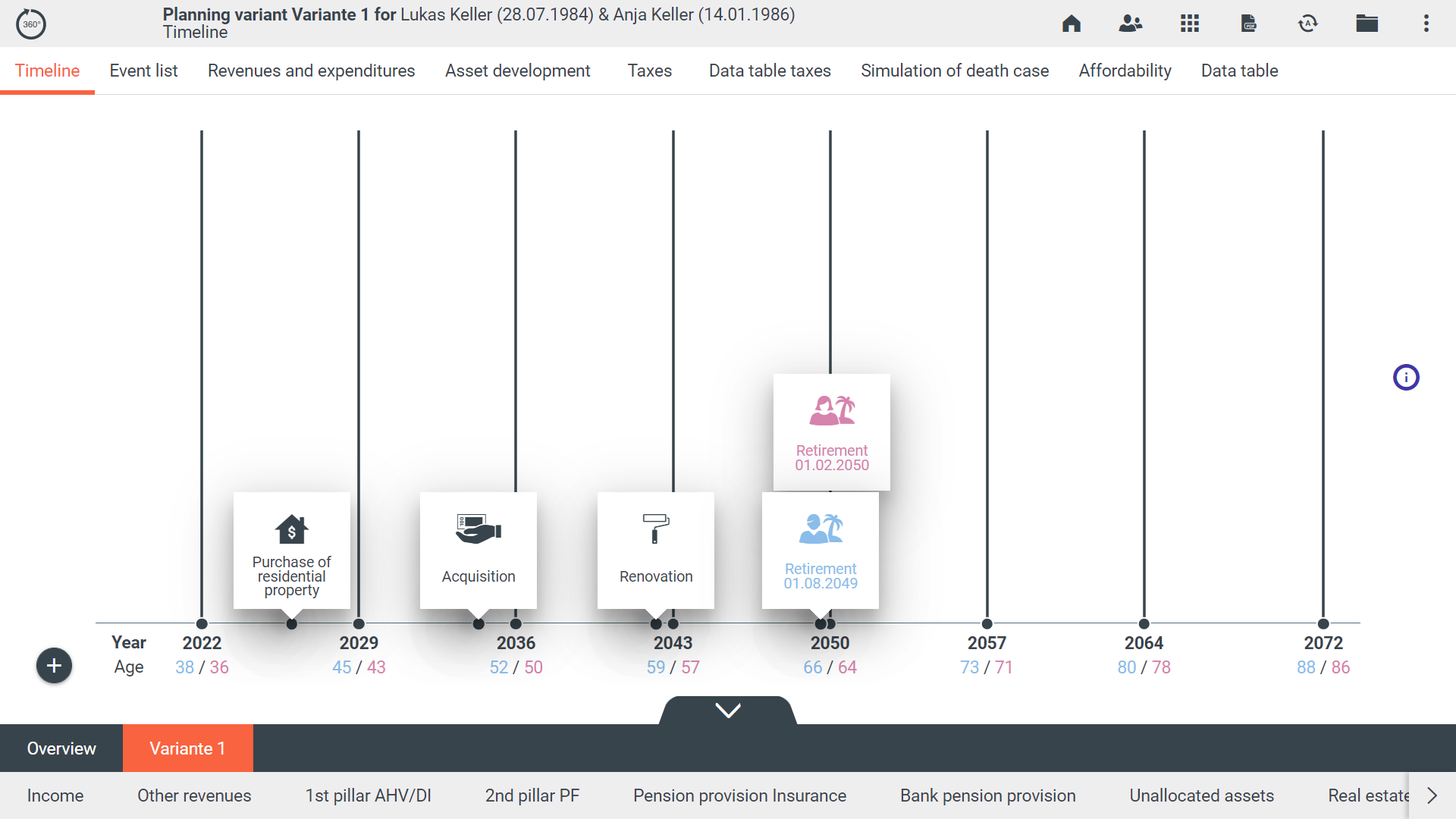

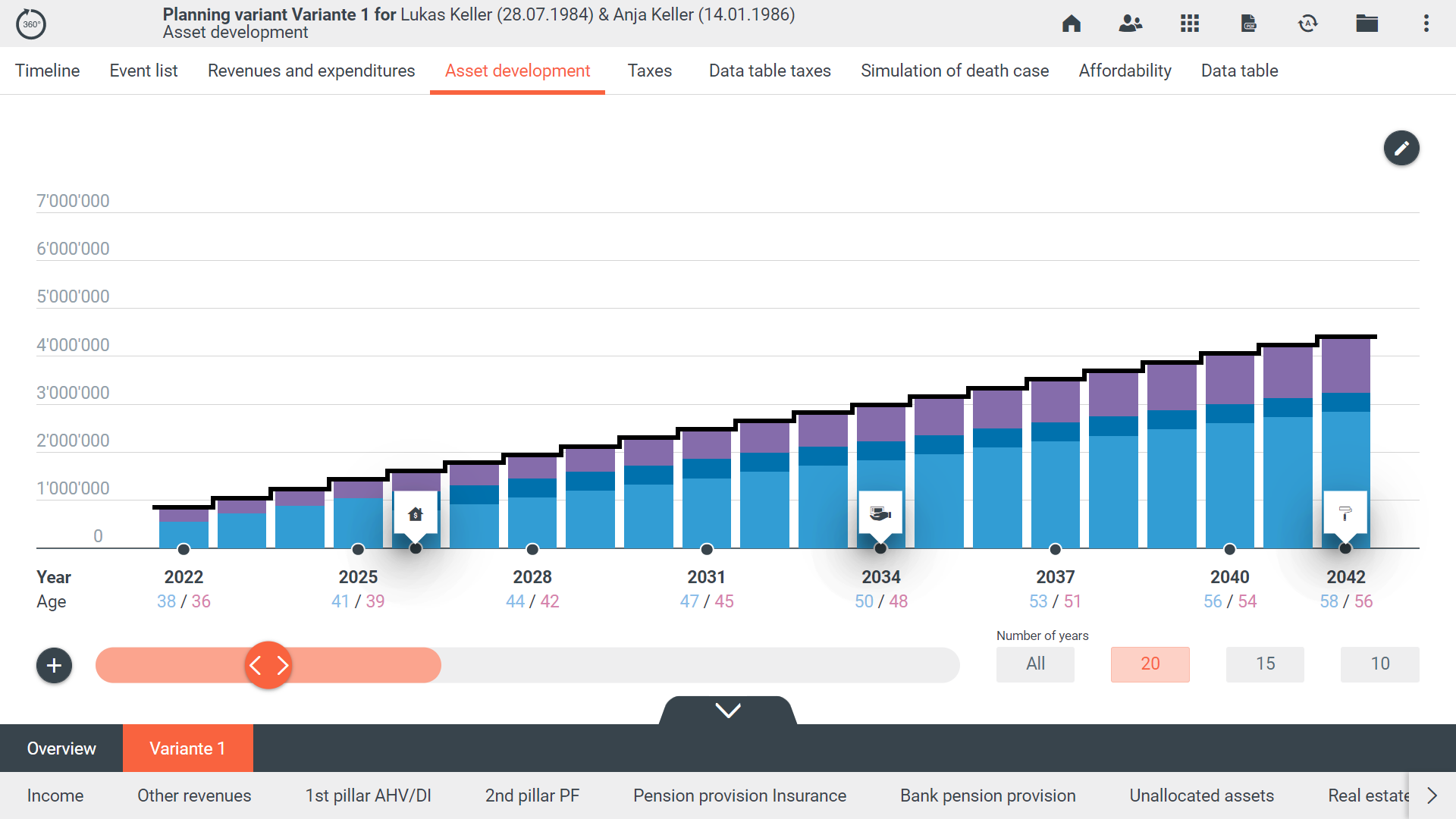

Life & pension planning

Module 6 of 11

The Life and pension planning module is a financial planning tool based on interactive life events and measures. A sophisticated variant functionality allows the advisor to create and compare different financial planning and/or pension planning scenarios. The individual life events and measures can be managed interactively. All income and wealth simulations can be shown forward or backward-looking. The module can either be used for life planning or pension planning with reduced functionalities.

Life planning:

- 360° life-cycle planning with interactive life events

Retirement planning:

- Income & capital requirements

- Annuity or capital

- Early or partial retirement

- Capital consumption

- Tax optimisation

- AHV advance withdrawal

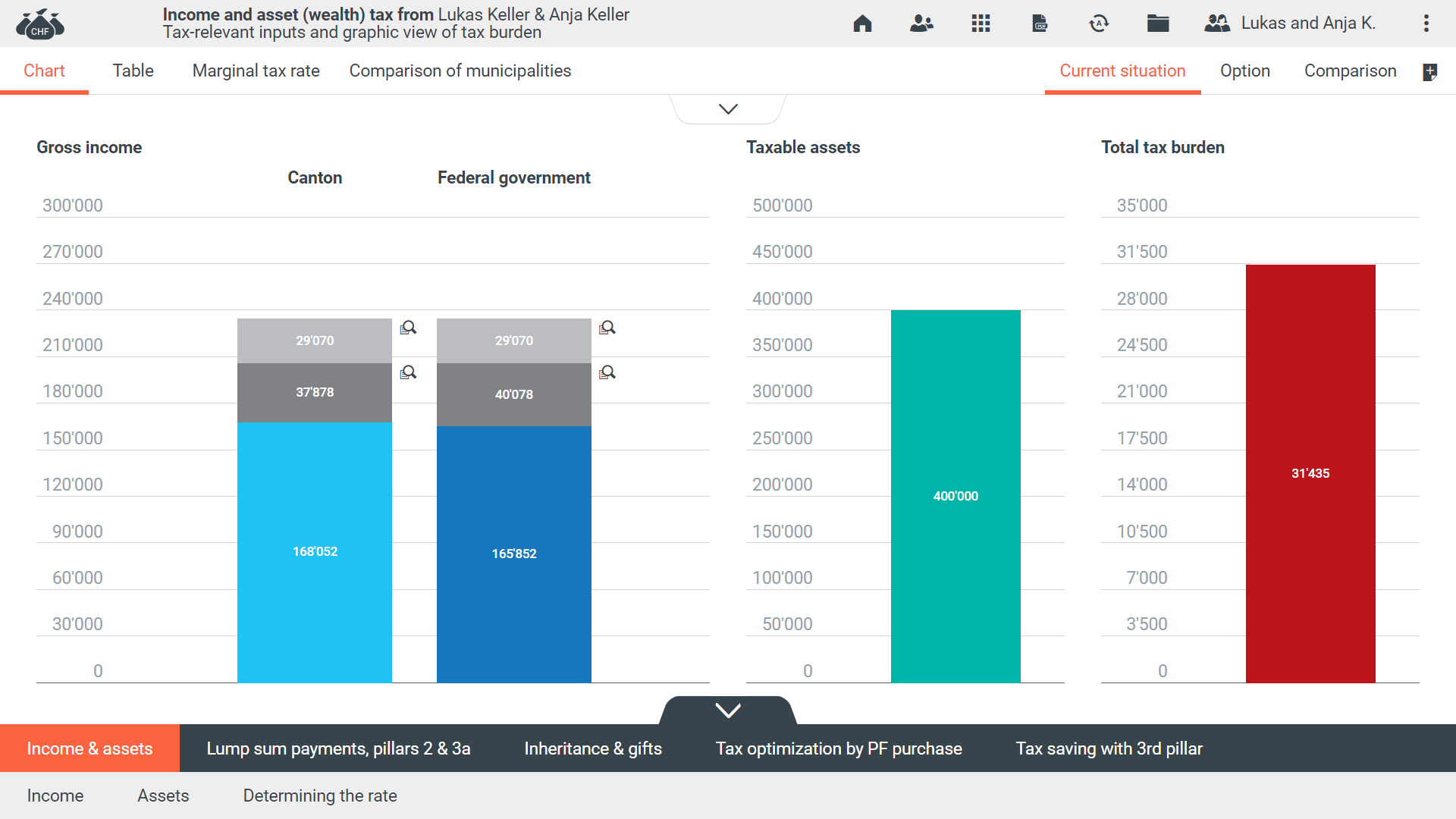

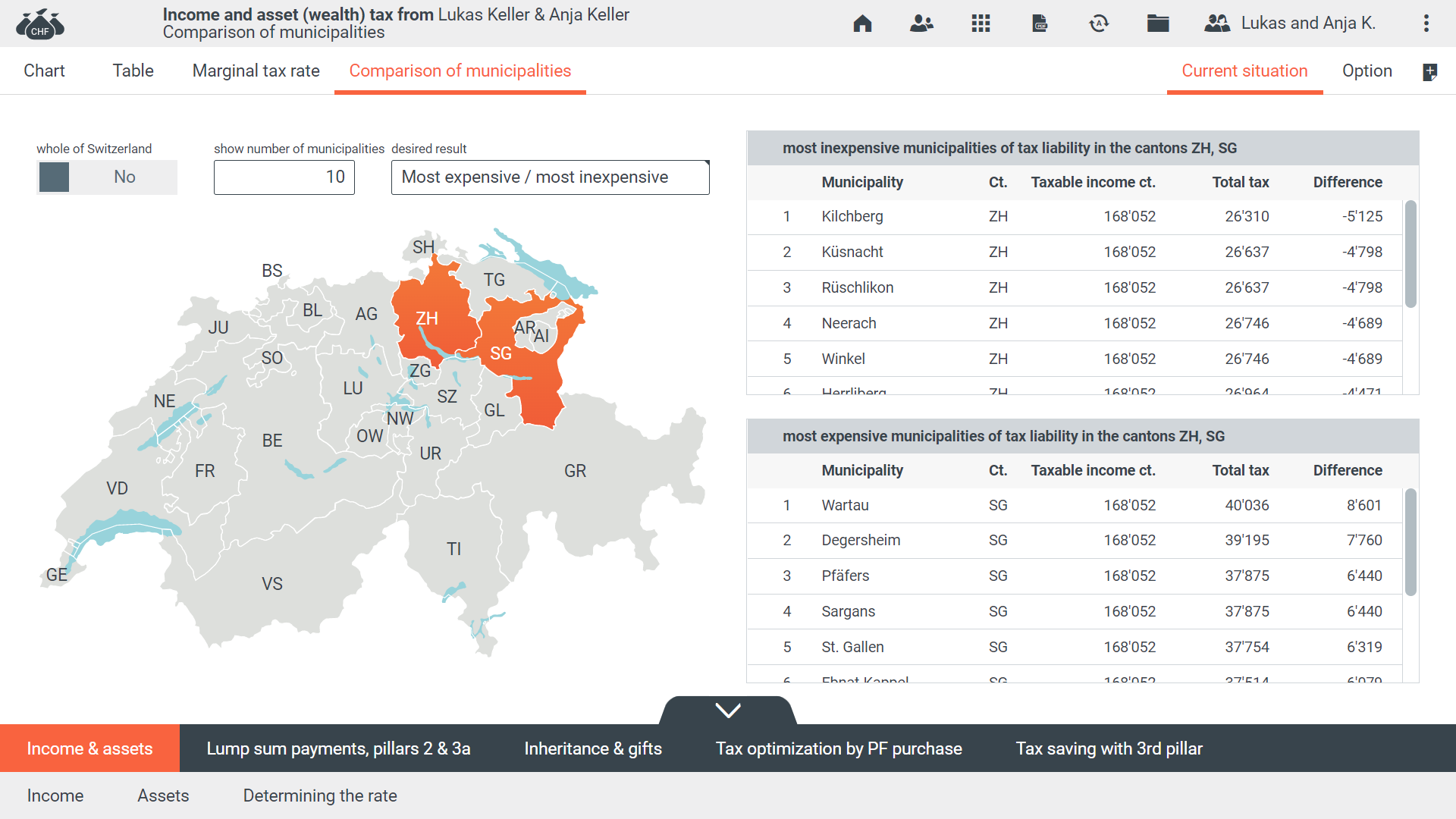

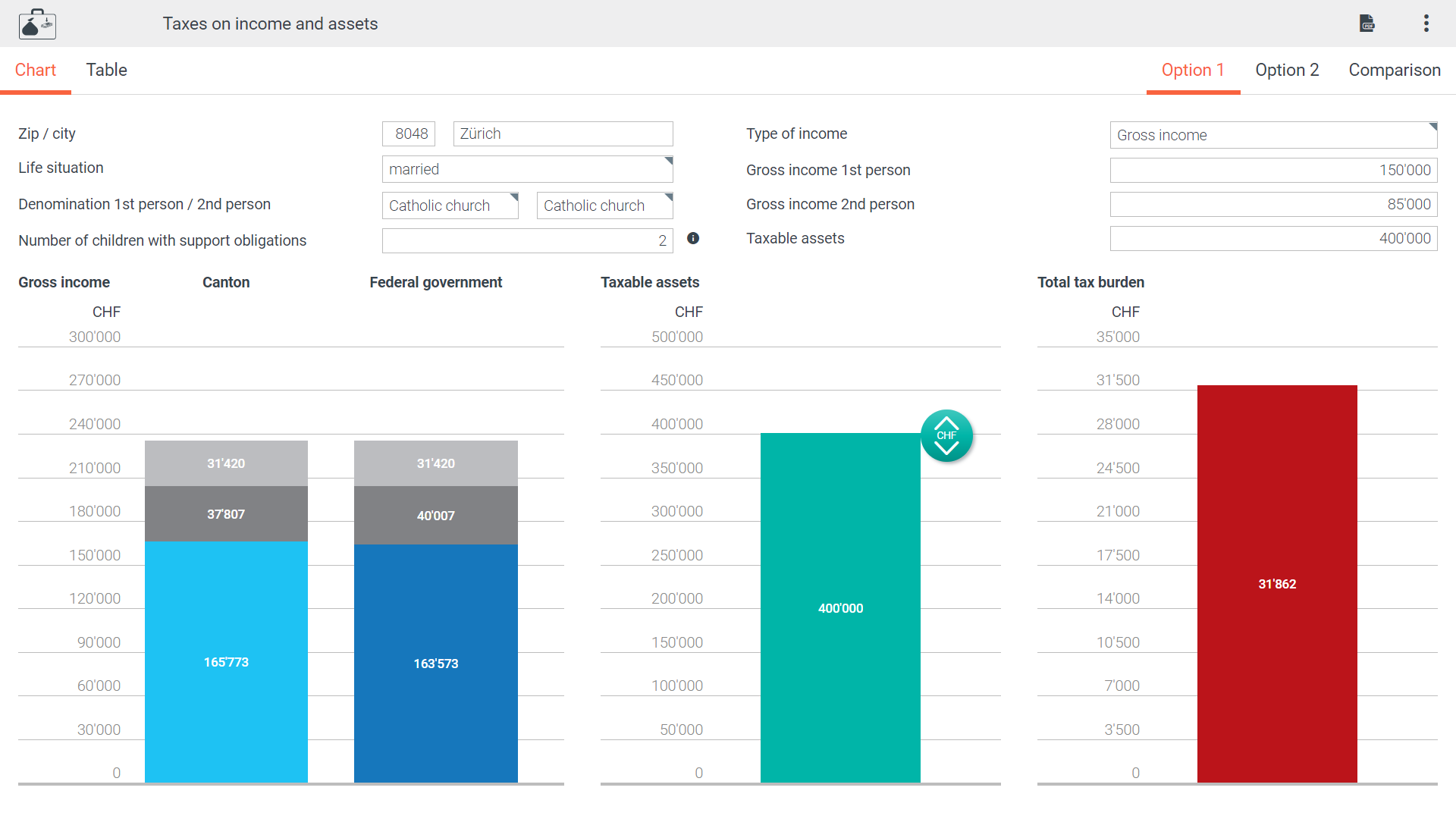

Taxes

Module 7 of 11

The Taxes module shows the impact of various tax types in the current situation. It also aids in tax optimisation. Comprehensive comparisons can be simulated and savings for the customer can be shown. Tax data is collected nationwide and updated several times a year. Data sourcing and updating is done in-house.

Topics & functions

- Taxes on income & wealth (including marginal tax rate and municipal comparison)

- Taxes on lumpsum payments in connection with pillar 2 & 3a (including marginal tax rate, municipality comparison and tax

- Inheritance & gift taxes

- Tax optimisation by PF purchase

- Tax savings with 3rd pillar

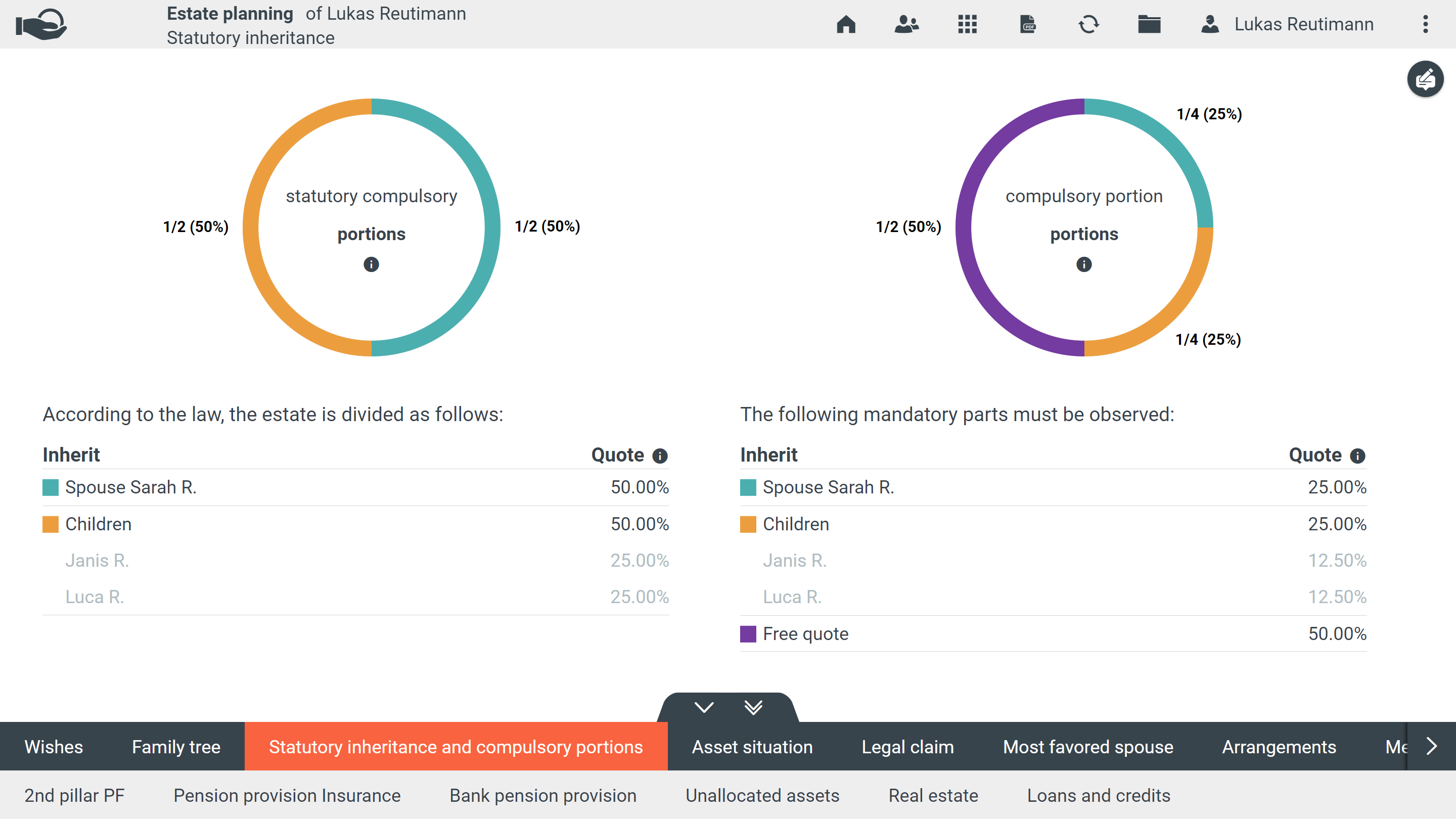

Inheritance & bequeathing

Module 8 of 11

The Inheritance & bequeathing module is used to determine the statutory inheritance portions and compulsory portions depending on the relationship. In addition, it can be shown how a spouse can be favored by concluding a prenuptial agreement (with proposed allocation) and a will (allocation of available free quota) (most favored spouse).

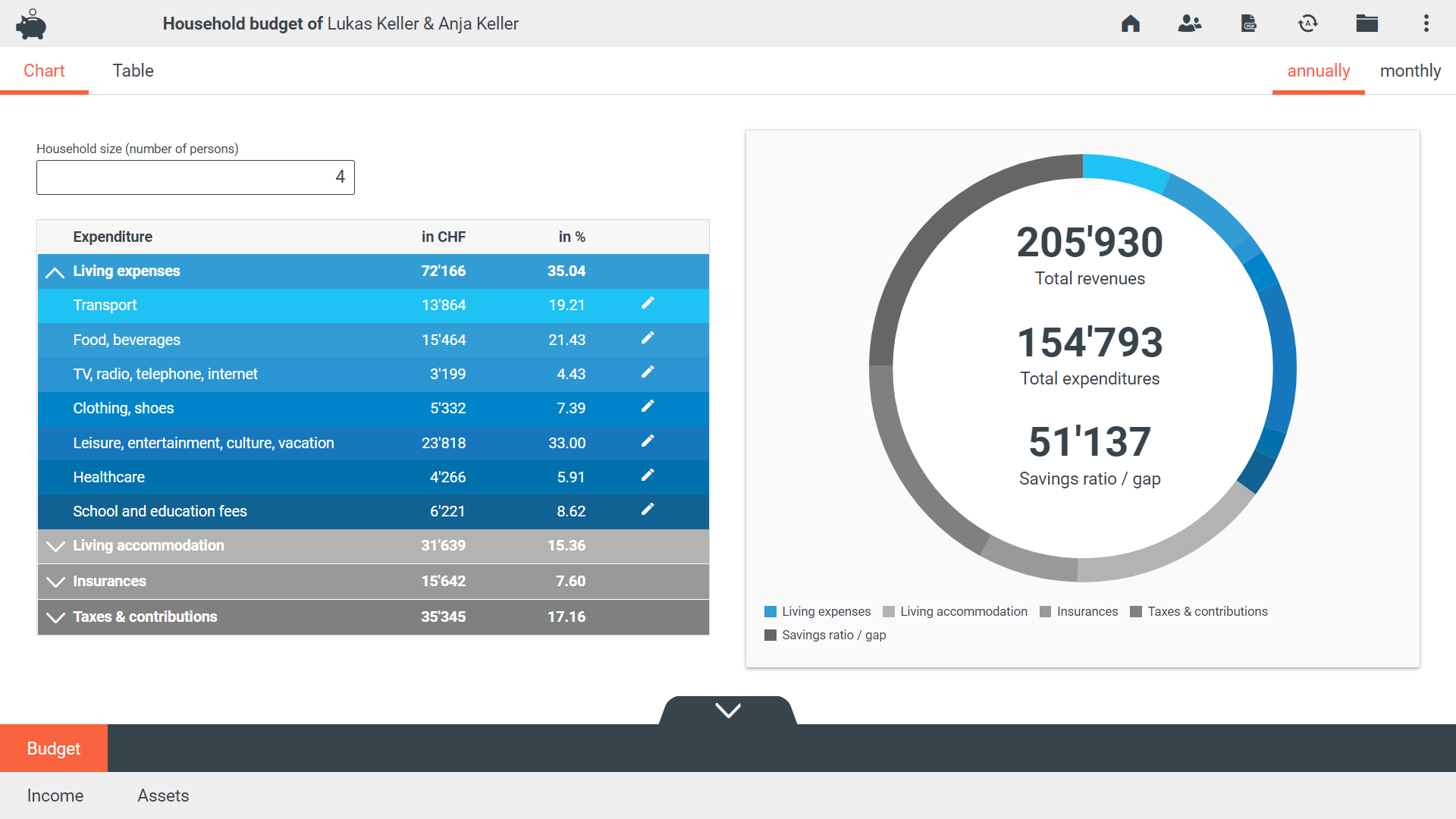

Household budget

Module 9 of 11

With the Omnium household budget, a simple budget plan can be made. The budget is based on statistical values of household size and income as well as the calculation of effective taxes.

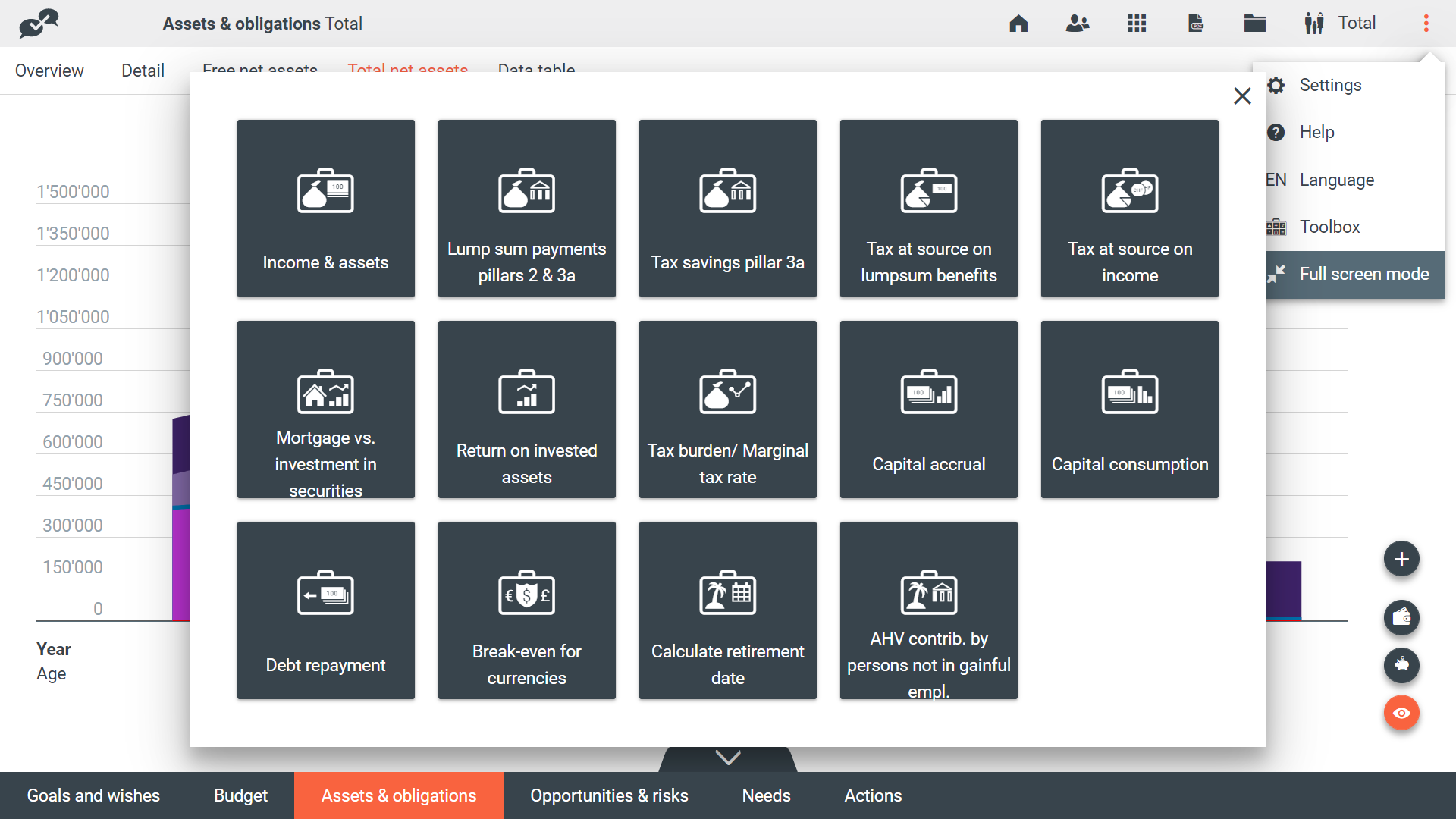

Toolbox

Module 10 of 11

The various toolbox calculators are an ideal addition. They allow quick calculations of taxes, capital accumulation/capital depletion and yield comparisons. The calculators can be called up in any module. A summary of the calculations can be printed out.

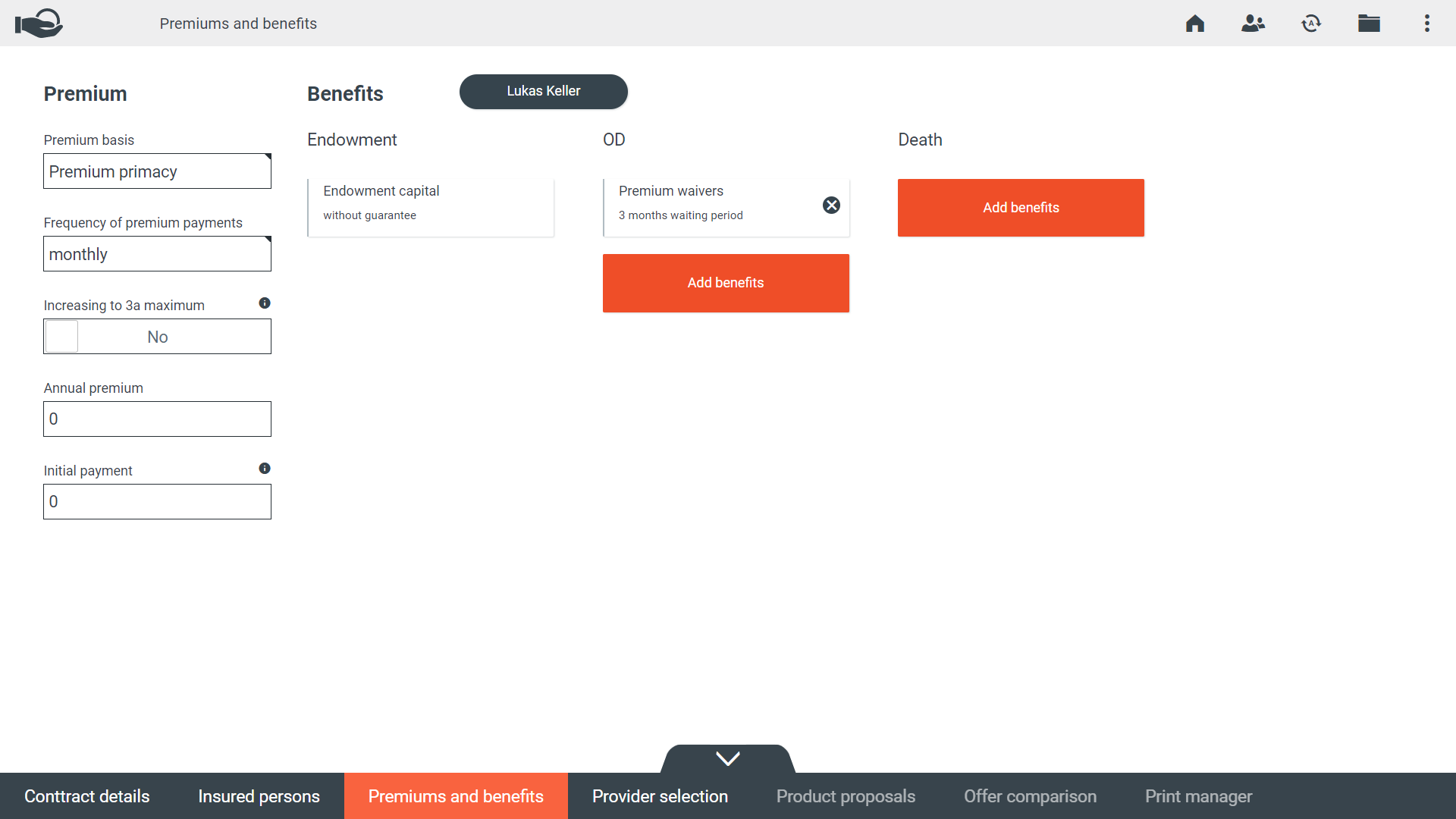

Products & Offering

Module 11 of 11

The offer calculator enables a comparison of service components at product level. Various individual products and/or product packages can be obtained digitally from different providers. From a rough to a final detailed quote, all documents are captured, processed and merged into a customer dossier. The offercalculator works with several quote systems and is currently in use in the life insurance sector.

Topics & functions

- Capturing of data regarding contract and insured person

- Definition of premiums and benefits

- Selection of partners and product selection (integration of n-offer systems)

- Offer comparsion

Financial calculators

The various toolbox calculators are an ideal addition. They allow quick calculations of taxes, capital accumulation/capital depletion and yield comparisons. The calculators can be called up in any module. A summary of the calculations can be printed out.